Corporate News Analysis: Insider Activity and Market Dynamics at Amprius Technologies Inc.

Insider Transactions and Corporate Governance

On January 28, 2026, Chief Technology Officer Stefan Constantin Ionel executed a series of Rule 10b‑5‑1 trading plan transactions that reflect a disciplined accumulation strategy. Ionel purchased 90 shares at $0.62 each and an additional 39,600 shares at $0.05 while simultaneously selling 39,690 shares at $12.00. The net effect increased his holding to 748,696 shares—approximately 0.05 % of Amprius’s outstanding equity. The timing—shortly after the stock closed at $13.58—suggests a confidence‑building move rather than a speculative play. Investors and analysts are likely to view this as a positive signal: the CTO is aligning his personal capital with the company’s long‑term trajectory, a classic marker of insider conviction.

The pattern of Ionel’s trades is consistent with a broader trend. Over the past month, he has accumulated 1.1 million shares at low prices (often $0.05–$0.45) while selling approximately 1.3 million shares at market rates ranging from $10.51 to $12.04. Executed under a pre‑approved 10b‑5‑1 plan, these transactions mitigate concerns about market timing and regulatory scrutiny. The strategy—buying when the market is depressed and selling when the stock has appreciated—aligns personal wealth management with corporate performance.

Implications for Investors and Market Perception

| Implication | Analysis |

|---|---|

| Confidence Indicator | Consistent insider buying at prices well below market is often interpreted as a strong endorsement of the company’s future prospects. For Amprius, operating in a highly volatile energy‑storage niche, this may help calm price swings and attract risk‑averse investors. |

| Liquidity Considerations | Bulk of Ionel’s sales occur at higher prices, providing liquidity to the market. However, the cumulative net position remains small relative to the company’s $1.46 billion market cap, limiting any outsized market impact. |

| Signal of Management Alignment | As CTO, Ionel’s stake is a proxy for the technical direction of the firm. His purchasing activity suggests confidence in ongoing product development, especially high‑energy lithium‑ion batteries that underpin Amprius’s core revenue streams. |

Consumer Trends and Market Dynamics

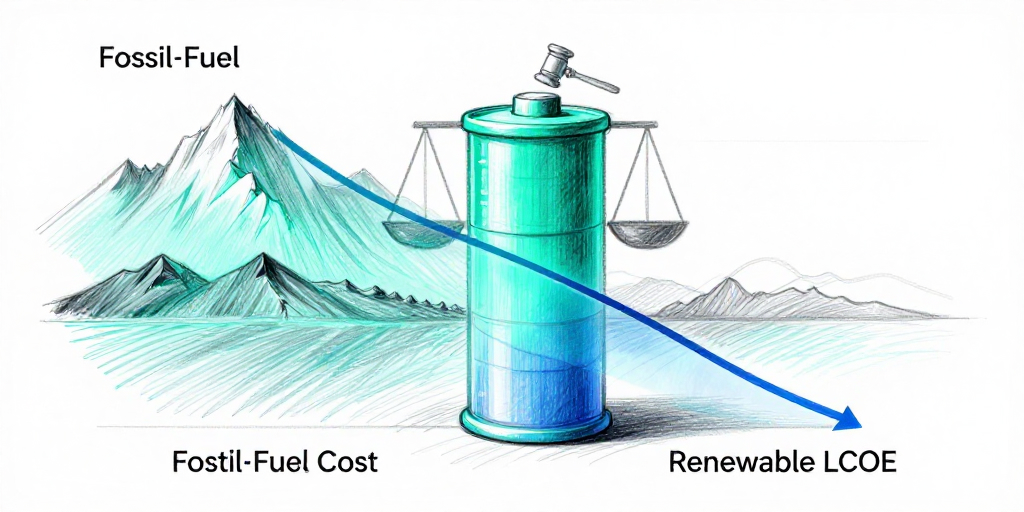

While insider activity provides an internal view of confidence, external market forces shape the broader competitive landscape. Consumer demand for energy‑efficient storage solutions is rising across several demographics:

Millennial and Gen Z Homeowners – This cohort increasingly adopts solar‑plus‑storage systems to reduce dependence on utility grids. Their preference for sustainable products drives demand for high‑energy density batteries, a niche where Amprius’s lithium‑ion technology is positioned.

Commercial Real Estate Operators – Rising energy costs and regulatory incentives for renewable integration push commercial clients toward robust backup solutions. Amprius’s focus on scalability and modular design appeals to this segment.

Industrial Automation Segments – The expansion into satellite and robotics markets signals a shift toward high‑performance batteries in critical applications. Demand from aerospace and defense industries for reliable, long‑life power supplies is a growing driver.

Economic shifts, such as tightening credit conditions and fluctuating commodity prices, have amplified volatility in the energy‑storage sector. Despite this, Amprius’s low‑cost insider buying suggests a belief in the company’s ability to navigate price swings and deliver sustainable growth.

Brand Performance and Retail Innovation

Amprius’s brand performance is reflected in its price‑to‑book ratio and negative P/E—indicators that investors view the company as a growth asset rather than a cash‑generating enterprise. The company’s emphasis on innovation—through research partnerships and a growing patent portfolio—positions it favorably against competitors. Retail innovation is evident in the introduction of plug‑and‑play modules for residential installations and an online configurator that tailors battery capacity to customer usage profiles.

Retail spending patterns show a gradual shift from bulk purchases to subscription‑based services. Amprius’s upcoming service‑as‑a‑platform model, which offers maintenance and performance monitoring, aligns with this trend and could unlock recurring revenue streams.

Future Outlook

- Monitoring: Investors should track subsequent 10b‑5‑1 filings and quarterly earnings to assess whether Ionel’s conviction translates into tangible performance improvements.

- Market Signals: A continued pattern of disciplined accumulation and timely divestiture could serve as a barometer for the company’s technical leadership and future growth prospects.

- Consumer Impact: As demand for high‑energy batteries grows across residential, commercial, and industrial segments, Amprius’s strategic focus on scalability and modularity positions it to capture a significant share of the evolving market.

In summary, while Amprius Technologies remains volatile, the consistent, low‑price insider purchases by CTO Stefan Constantin Ionel inject a modest dose of confidence into the equity. Coupled with rising consumer demand for advanced energy‑storage solutions, the company’s brand performance and retail innovation initiatives suggest a positive trajectory for stakeholders willing to navigate the sector’s inherent risks.