Insider Trading Activity at Applied Energetics

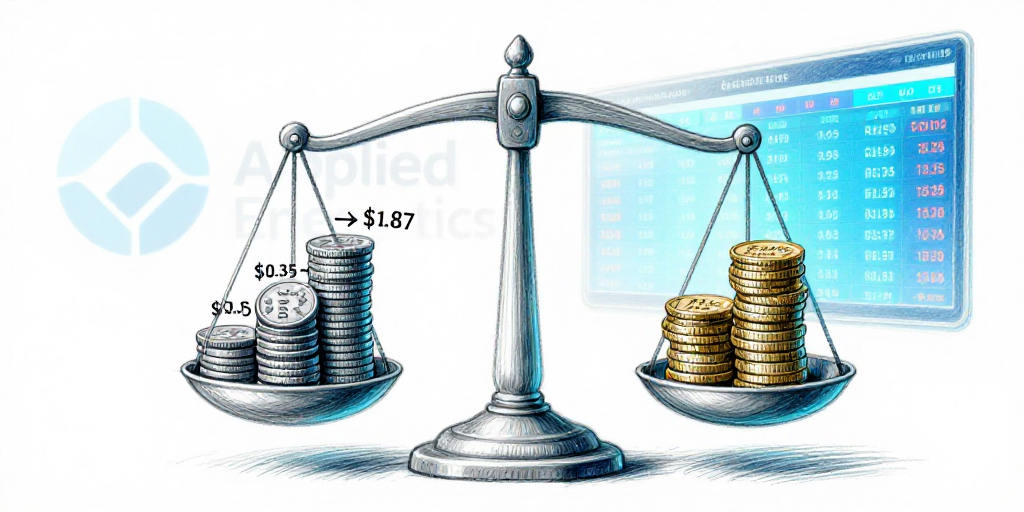

The most recent transaction disclosed for January 21, 2026, involved Quarles Gregory James, the company’s CEO Emeritus, executing a compact trading cycle that encompassed the purchase of 6,600 shares at $0.35 per share, the sale of an equal quantity at $1.87, and the concurrent exercise and liquidation of 6,600 non‑qualified stock options. The trades were reported as service‑related option grants and ordinary share transactions, with no indication of a broader strategic shift or change in managerial intent.

Transaction Anatomy

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026‑01‑21 | Quarles Gregory James (CEO Emeritus) | Buy | 6,600 | $0.35 | Common Stock |

| 2026‑01‑21 | Quarles Gregory James (CEO Emeritus) | Sell | 6,600 | $1.87 | Common Stock |

| 2026‑01‑21 | Quarles Gregory James (CEO Emeritus) | Sell | 6,600 | $0.00 | Non‑Qualified Stock Options |

| 2032‑11‑29 | Quarles Gregory James (CEO Emeritus) | Holding | 1,954,545 | N/A | Restricted Stock Units |

The purchase price of $0.35 is significantly below the market close of $1.795 on the day of the trade, suggesting the buy may have been executed under a lock‑in or vesting‑triggered arrangement that enabled a low‑cost acquisition of shares. The subsequent sale at $1.87, close to the prevailing market price, represents a classic round‑trip strategy, allowing James to generate cash from the exercise of options while maintaining exposure to the underlying equity.

Market Dynamics and Liquidity Impact

Applied Energetics trades on the over‑the‑counter (OTC) market, where liquidity is inherently limited. A single transaction involving 6,600 shares represents a measurable percentage of the outstanding float, thereby amplifying the potential for short‑term price volatility. While the round‑trip maneuver does not signal a loss of confidence—James retains substantial Restricted Stock Units (RSUs) that will vest in 2032—the temporary liquidity influx can momentarily depress the share price, especially in a thinly traded environment.

Competitive Positioning and Sector Context

Applied Energetics operates within the laser‑based defense systems niche, a segment characterized by high technical barriers to entry, stringent regulatory oversight, and reliance on government contracts. The company’s current financial profile—negative price‑to‑earnings ratio and a steep decline in market capitalisation relative to its 1992 IPO—underscores the challenges faced by firms in this specialty field. Nonetheless, the persistence of long‑term equity holdings by senior management suggests an ongoing belief in the company’s strategic trajectory.

Economic Factors and Investor Implications

The rapid buy‑sell activity observed in January 2026 aligns with a broader pattern of short‑term liquidity management among senior insiders. This approach enables the generation of cash that can be allocated toward future capital expenditures or personal liquidity needs without diluting the existing shareholder base. For investors, the key considerations are:

- RSU Vesting Schedule: The sizeable RSU position (1,954,545 shares) that will vest in 2032 serves as a long‑term alignment mechanism, reinforcing managerial commitment to the firm’s prospects.

- Capital Structure: Given the company’s negative valuation multiples, securing strategic partnerships or new defense contracts could improve earnings stability and mitigate liquidity concerns.

- Volatility Sensitivity: The OTC listing amplifies the effect of insider trades on share price, necessitating close monitoring of trade volumes relative to the company’s float.

Outlook for Applied Energetics

If the company can secure additional defense contracts and strengthen its earnings profile, the existing long‑term insider commitment may act as a stabilizing factor. Conversely, continued aggressive trading and a lack of significant capital inflows could foreshadow liquidity challenges. Financial professionals should therefore focus on:

- Tracking the vesting of RSUs to gauge long‑term insider confidence.

- Monitoring trade volumes relative to the OTC float to assess potential market impact.

- Assessing the company’s debt and liquidity ratios in light of its current valuation metrics.

In summary, the January 21, 2026 transaction, while routine in its structure, exemplifies the dual strategy employed by Applied Energetics’ leadership: leveraging short‑term trades for liquidity while maintaining a substantial long‑term stake that aligns managerial interests with shareholder value.