Insider Activity at Bruker Corp. – A Closer Look

The recent trading activity by Munch Mark, Executive Vice‑President and President of Bruker Nano, provides a micro‑cosm of the broader strategic posture that biotechnology and pharmaceutical companies are adopting in the face of evolving market dynamics. Mark’s simultaneous purchase and sale of 2,000 shares, coupled with the exercise of a fully vested stock‑option tranche, illustrates a disciplined approach to capital allocation that aligns closely with long‑term commercial objectives and competitive positioning.

Commercial Strategy and Market Access

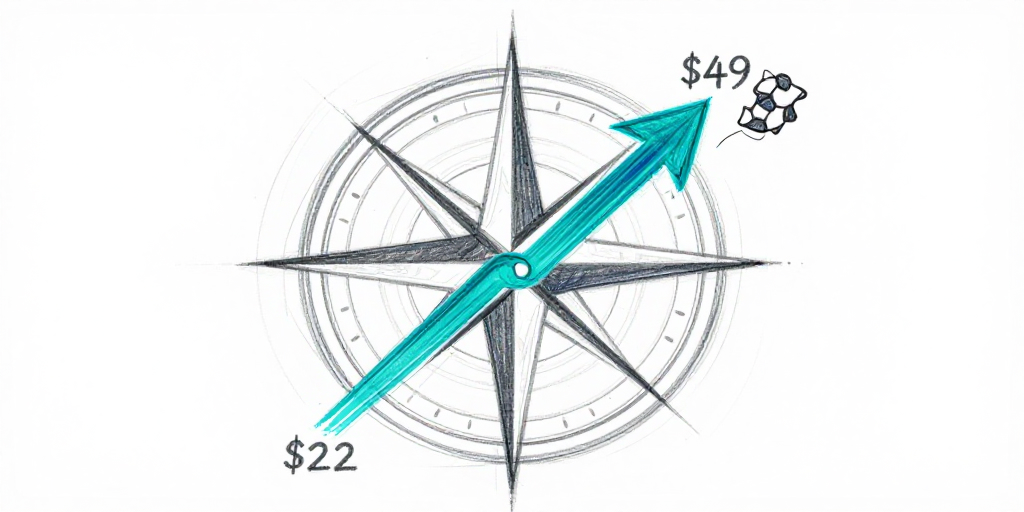

The dual transaction—buying at $22.19 and selling at $49.20—suggests a Rule 10b‑5‑1 trading plan designed to capture short‑term gains while maintaining a foothold in the company. In the biotech and pharma context, such a pattern signals confidence that the company’s pipeline, pricing strategy, and reimbursement landscape will support a rebound in share value. The option exercise at zero cost further underscores commitment; it aligns executive incentives with quarterly performance targets that are often tied to regulatory approvals, payer agreements, and market access milestones.

For investors, these moves indicate that Bruker is pursuing a commercial strategy that balances aggressive market entry with prudent risk management. By locking in gains at a high valuation and reinforcing ownership at a lower price point, the company’s leadership demonstrates an understanding of the importance of sustaining a shareholder base that can weather the cyclical nature of drug development and reimbursement negotiations.

Competitive Positioning

Bruker’s recent volatility— a 6 % slide on January 13 followed by an 11 % weekly decline—has been amplified by investor unease surrounding earnings forecasts and a cost‑cutting initiative. However, the insider activity paints a different narrative. While competitors in the biotech and pharma space often rely on high‑profile acquisitions or spin‑outs to strengthen their portfolios, Bruker’s leadership appears to be investing in internal capabilities and incremental gains. The pattern of disciplined buying and selling, combined with a significant option exercise, positions Bruker as a firm that is willing to endure short‑term volatility in exchange for long‑term competitive advantage.

This approach aligns with industry best practices where companies maintain a strong pipeline while strategically managing their capital structure. By retaining a substantial shareholding, executives signal to payers and partners that they are invested in the company’s ability to secure favorable pricing and reimbursement terms, which are critical for maintaining market access in a crowded therapeutic space.

Feasibility of Drug Development Programs

The feasibility of Bruker’s drug development programs can be inferred from the insider’s confidence. The purchase of shares at $22.19, a price significantly lower than the recent peak of $49.20, indicates an expectation that the company’s research and development initiatives will achieve regulatory milestones that unlock value. Executives who engage in such transactions often have access to internal forecasts regarding clinical trial timelines, anticipated FDA approvals, and potential partnership deals that can accelerate commercialization.

Moreover, the option exercise, which is fully vested and executed without cash, suggests that the company’s management team is confident that ongoing R&D activities will meet key performance indicators. In the biotech and pharma sectors, where drug development can span a decade and involve billions of dollars, such confidence is a strong indicator that the company’s pipeline has both scientific merit and commercial viability.

Investor Takeaway

- Strategic Confidence – Munch Mark’s buy‑sell pattern reflects a belief in Bruker’s turnaround strategy and its capacity to regain market traction.

- Long‑Term Alignment – The option exercise confirms that the executive team is focused on long‑term value creation rather than short‑term liquidity.

- Market Reaction Context – The muted market reaction to insider trades, especially following robust corporate disclosures, suggests that the company’s narrative is resonating with stakeholders.

- Future Insight – Monitoring subsequent Rule 10b‑5‑1 plans will provide additional signals regarding insider sentiment and strategic priorities.

In summary, Bruker’s insider activity, led by Munch Mark, exemplifies a measured yet assertive approach to capital allocation within a highly competitive biotech and pharmaceutical environment. While short‑term share price fluctuations continue, the leadership’s actions reinforce a narrative of disciplined execution, strategic market access, and a credible pipeline that collectively enhance the feasibility of future drug development initiatives.