Insider Buying Signals a Strong Confidence in Monolithic Power Systems

Monolithic Power Systems (MPS) reported a significant insider transaction on February 3, 2026: CEO Hsing Michael purchased 136,825 shares of the company’s common stock. The acquisition, executed at the market price of $1,158.89, followed the vesting of performance‑based restricted stock units granted in February 2023.

The transaction occurred immediately after the company’s latest quarterly earnings report, a timing that suggests a strategic, long‑term view rather than a speculative play. At the time of purchase, MPS’s share price had increased by only +0.02 %, closing at $1,136.83.

Market Dynamics

| Metric | Value |

|---|---|

| Market cap | $54.4 billion |

| Price‑to‑earnings (P/E) | 29.22 |

| Recent earnings beat | Yes |

| Analyst price target lift | Yes |

| Social‑media sentiment score | +81 |

| Buzz spike around filing | 927 % |

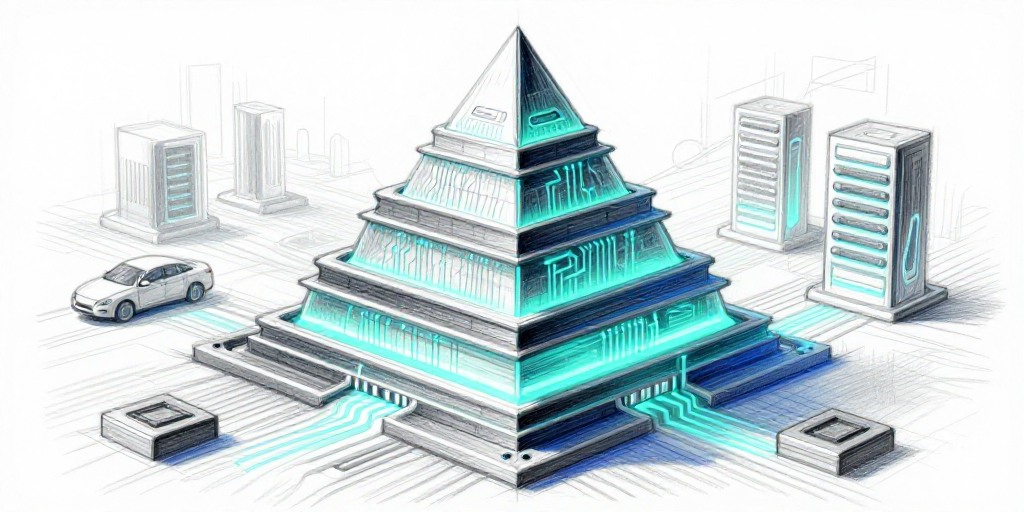

Sector Growth – MPS operates within the high‑growth semiconductor market, specializing in power‑management chips that are critical for automotive electronics and artificial‑intelligence workloads. Demand for these components is projected to rise as electric vehicles (EVs) and AI accelerators become more prevalent.

Competitive Positioning – MPS’s product portfolio is differentiated by its integration density and energy efficiency. While it competes with larger incumbents such as Texas Instruments and Infineon, it also contends with niche players like Analog Devices. The company’s recent earnings beat has reinforced its positioning as a reliable supplier in a rapidly expanding niche.

Economic Factors – Global semiconductor supply chains remain constrained, creating a supply‑side scarcity that can drive up prices for high‑demand components. Inflationary pressures have been partially offset by increased industrial automation, which sustains demand for power‑management solutions.

CEO Trading Pattern

Hsing Michael’s trading history over the past 12 months demonstrates a “buy‑when‑it‑matters” strategy:

| Date | Transaction | Shares | Context |

|---|---|---|---|

| 2025‑10‑30 | Sale | 121,918 | After a high‑price rally |

| 2026‑02‑03 | Purchase | 136,825 | Following vesting of RSUs and a recent earnings beat |

The CEO’s overall activity includes over 1 million shares held and approximately 1.4 million shares sold during the year. His buying activity typically aligns with performance milestones, while his selling occurs near market peaks, indicating a disciplined approach focused on long‑term value rather than short‑term speculation.

Competitive Landscape

- Peers: Texas Instruments, Analog Devices, Infineon, ON Semiconductor.

- Differentiation: MPS offers higher integration density and lower power consumption, which are critical for automotive and AI applications.

- Strategic Alliances: Partnerships with major automotive OEMs and semiconductor design houses strengthen market access and supply chain resilience.

Economic Context

- Macroeconomic Trends: The U.S. and Chinese automotive markets are projected to grow by 7–9 % annually, driving demand for power‑management ICs.

- Supply Chain Recovery: Continued improvement in semiconductor supply chain logistics is expected to reduce lead times, benefiting companies like MPS that rely on rapid production cycles.

- Regulatory Environment: Upcoming emissions and safety regulations for EVs are likely to accelerate adoption of advanced power‑management solutions.

Investor Implications

- Positive Signal – The CEO’s purchase, combined with robust earnings prospects and favorable market sentiment, signals strong insider confidence.

- Risk Management – The CEO’s substantial prior selling activity suggests ongoing risk mitigation; investors should monitor future transactions for indications of market sensitivity.

- Exposure Decision – For investors seeking growth within the semiconductor space, MPS presents a compelling opportunity, particularly as its product suite aligns with emerging industry trends in automotive electrification and AI acceleration.

Summary

Hsing Michael’s February 2026 purchase of 136,825 shares reflects a disciplined, long‑term investment strategy rooted in performance milestones and market fundamentals. Coupled with MPS’s solid market position, growing demand for power‑management solutions, and favorable economic conditions, the insider activity reinforces a bullish outlook. Investors should, however, remain attentive to subsequent CEO trades and broader market dynamics when considering allocation to MPS.