Insider Buying Frenzy at Cosmos Health – What It Means for Investors

Executive Overview

Recent filings under Regulation S‑4 disclosed that Siokas Grigorios, Chief Executive Officer of Cosmos Health, has executed a purchase of 493,495 shares of the company’s common stock at a price of $0.4458 per share. The transaction was completed through a debt‑exchange agreement, effectively converting a $220,000 debt obligation into equity. This event is part of a broader pattern of insider buying that has persisted since early January, with the CEO acquiring an estimated 100 – 200 thousand shares each week.

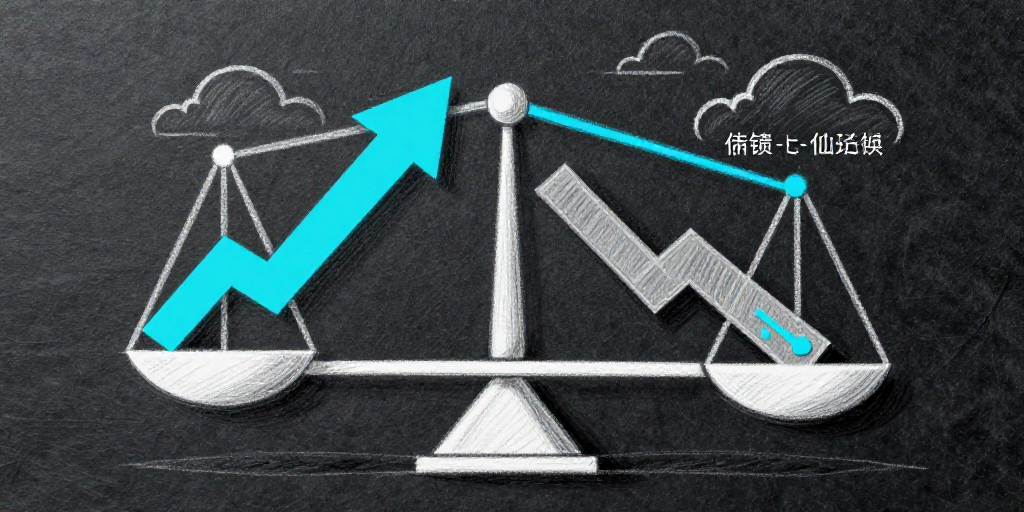

Market Dynamics

Cosmos Health’s share price has experienced a significant decline, sliding 5.97 % over the last week and falling 43 % year‑to‑date. Despite these fluctuations—ranging between $0.28 and $1.32 over the past year—insider activity has remained remarkably steady. The most recent purchase, while modest relative to the company’s total shares, occurs in a context of negative earnings per share (P/E of –0.71) and a market capitalization of approximately $17 million.

The market’s reaction has been cautious: the stock’s price changed by a mere +0.01 % following the transaction, and social‑media sentiment remains negative at –2. Nevertheless, discussion volume has spiked 113.5 %, indicating heightened analyst and investor attention.

Competitive Positioning

Cosmos Health operates in the generics and nutraceuticals sector, a niche characterized by relatively low capital intensity but high regulatory scrutiny. The company’s recent manufacturing agreement with Libytec represents a strategic move to secure supply chain stability and scale production. In a market where competitors range from large multinational pharmaceutical firms to boutique contract manufacturers, such partnerships can be pivotal for early-stage companies seeking to establish credibility and operational capacity.

Insider confidence, as demonstrated by CEO Grigorios’s ongoing purchases, can act as a catalyst for short‑term price appreciation, particularly when external fundamentals are weak. However, the company’s current financials—negative profitability and limited operating cash flow—suggest that any price momentum will likely be temporary unless accompanied by substantive operational progress.

Economic Factors

The broader economic environment continues to exert pressure on small-cap biotechnology and healthcare firms. Interest rates remain elevated, and capital availability for growth-stage ventures has tightened. In this context, insider actions that signal commitment can be interpreted as a hedge against market volatility. Nevertheless, macroeconomic headwinds, such as inflationary pressures and supply chain disruptions, could dampen the company’s ability to convert its manufacturing agreements into profitable revenue streams.

Investor Implications

- Signal Strength

- The CEO’s persistent buying spree may be read as an endorsement of the company’s strategic direction, potentially encouraging a short‑term rally as market participants react to insider conviction.

- Liquidity and Price Impact

- Given that the volume of purchases constitutes a small fraction of the total shares outstanding, the immediate effect on liquidity and price dynamics is likely limited.

- Fundamental Considerations

- Investors must weigh insider optimism against the company’s ongoing need to achieve sustainable profitability. The lack of current earnings and reliance on future product commercialization represent significant risks.

- Monitoring Cadence

- Continuous observation of insider transactions, combined with quarterly earnings disclosures, will provide a clearer picture of whether the buying activity reflects genuine belief in future growth or is primarily a capital‑structure maneuver.

CEO Profile

Siokas Grigorios has maintained an average purchase price near $0.48 over the past year, slightly below the current market close of $0.468. His transactions have been exclusively “buy” orders, with no recorded sales, indicating a long‑term stake. Post‑transaction, Grigorios’s ownership exceeds 7 million shares, underscoring a significant personal commitment to Cosmos Health’s trajectory.

Conclusion

While Cosmos Health’s financials remain weak and its stock highly volatile, the CEO’s continued insider buying—culminating in the recent debt‑exchange transaction—serves as a cautiously optimistic signal for investors. The company’s strategic manufacturing partnership with Libytec provides a foundation for potential future earnings, but the path to profitability remains uncertain. Prospective shareholders should balance the insider confidence against the broader economic and competitive landscape, and remain attentive to forthcoming earnings releases for substantive evidence of growth prospects.

Transaction Table

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026‑01‑14‑05:00 | Siokas Grigorios (Chief Executive Officer) | Buy | 493,495.00 | 0.45 | Common Stock, par value $.001 |