Corporate News – Industrial Technology and Capital Dynamics

Overview of CSW Industrials’ Recent Insider Transaction

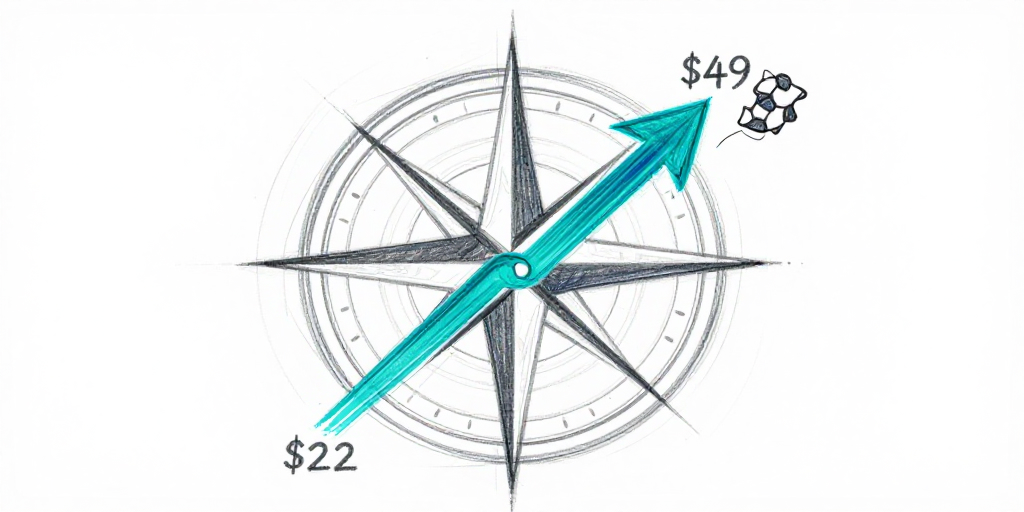

CSW Industrials Inc. (CSW) announced a 10(b)(5)(1) sale of 1,000 shares by Chairman, President, and Chief Executive Officer Joseph B. Armes on 15 January 2026. The transaction was executed at an average price of $328.64 per share, slightly above the closing price of $328.94 on that day. This event coincides with the company’s upward trajectory, reflected in a 3.6 % weekly gain and a 6.6 % monthly increase, bringing the share price close to a 52‑week high of $401.02.

From a governance standpoint, the sale complies with SEC‑mandated disclosure requirements and represents a routine liquidity maneuver rather than a discretionary sell. The market absorbed the transaction with a nominal 0.01 % intraday price lift, indicating that the trade did not trigger significant volatility. The broader investor community, as evidenced by modest social‑media sentiment (+10) and buzz (~11 %), remains largely indifferent.

Implications for Manufacturing Productivity and Capital Allocation

1. Liquidity and Capital Availability

The proceeds of the sale—approximately $328,640—provide the company with a modest cash reserve that can be allocated toward short‑term working‑capital needs or to finance incremental investments in manufacturing equipment. In the context of CSW’s capital‑intensive operations, even small injections of liquidity can be leveraged to accelerate deployment of high‑efficiency production lines, such as automated chemical dispensing systems or advanced process control units.

2. Strategic Investment in Industrial Automation

CSW has historically invested in precision manufacturing technologies to maintain competitive margins in the chemical distribution sector. The company’s ongoing commitment to automation—evidenced by recent upgrades to robotic handling stations and the integration of AI‑driven predictive maintenance—aligns with broader industry trends that emphasize reduced labor costs, higher throughput, and lower defect rates. A steady influx of capital supports these initiatives by enabling the purchase of modular robotic platforms and the installation of Internet‑of‑Things (IoT) sensors across the supply chain.

3. Productivity Gains through Process Optimization

By reallocating capital toward data‑analytics platforms, CSW can further refine its production scheduling algorithms. The result is a more responsive manufacturing cycle that aligns supply with real‑time demand forecasts, thereby reducing inventory holding costs and improving cash‑flow efficiency. These productivity gains have a multiplier effect on the regional economy: lower production costs translate into more competitive pricing for end‑users, stimulating demand for industrial chemicals and reinforcing the company’s position as a key supplier in the manufacturing ecosystem.

Technological Trends and Macro‑Economic Impact

4. Shift Toward Digital Twins and Simulation

CSW’s product portfolio has begun to incorporate digital‑twins—virtual replicas of physical processes that allow engineers to simulate production scenarios before implementation. Deploying such technology reduces the risk associated with large capital expenditures and accelerates the time‑to‑market for new process configurations. On a macro level, the adoption of digital twins contributes to a broader industrial shift toward more resilient supply chains, enhancing overall economic stability.

5. Sustainability and Green Manufacturing

The company is aligning its capital allocation strategy with global sustainability objectives. Investments in energy‑efficient HVAC systems, waste‑reduction technologies, and low‑carbon catalytic processes not only improve environmental performance but also position CSW favorably in markets where regulatory compliance and ESG credentials drive procurement decisions. These efforts dovetail with national initiatives aimed at reducing greenhouse‑gas emissions from manufacturing, thereby supporting long‑term economic growth without compromising competitiveness.

6. Capital Markets and Investor Confidence

The disciplined insider selling pattern—executed at market‑friendly prices under 10(b)(5)(1) plans—serves to reinforce investor confidence. By maintaining a substantial ownership stake (over 12 % of outstanding equity) and retaining performance‑rights that vest over 2025‑2028, the CEO signals a long‑term commitment to shareholder value. This governance stability is crucial for attracting long‑term capital, which in turn fuels the company’s ability to invest in capital‑intensive technologies and sustain productivity gains.

Conclusion

CSW Industrials’ recent insider transaction illustrates a classic liquidity strategy that has minimal immediate impact on share price or investor sentiment. Crucially, the capital raised can be deployed to reinforce the company’s focus on manufacturing productivity, automation, and sustainable practices—areas that are pivotal to maintaining competitive advantage in a rapidly evolving industrial landscape. By aligning short‑term liquidity needs with long‑term capital investment in advanced manufacturing technologies, CSW is positioning itself to drive economic value both for its shareholders and for the broader manufacturing sector.