Energy Markets in 2026: Production, Storage, and Regulatory Dynamics

Production Outlook

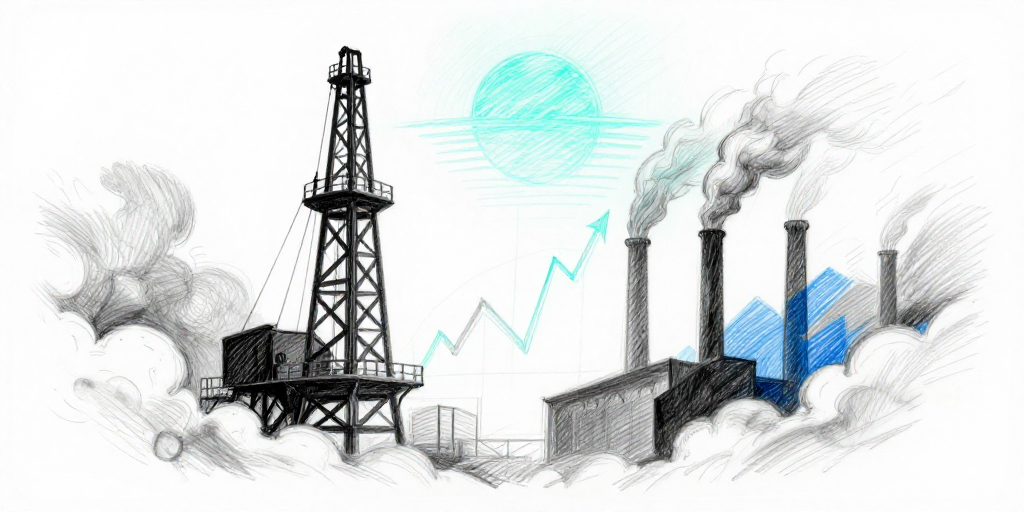

The global energy mix continues to shift as traditional hydrocarbon production competes with expanding renewable capacity. In 2026, oil and natural gas production in the United States is projected to remain flat or decline modestly, reflecting the cumulative impact of shale plateauing and a gradual transition toward lower‑carbon fuels. Internationally, the Middle East retains a leading position, but its output trajectory is increasingly constrained by OPEC+ quota adjustments and the growing demand for cleaner energy sources.

Natural gas, while still the largest single source of energy by volume, is experiencing a modest decline in new field development. The remaining projects focus on extending the life of existing assets rather than introducing new wells. This trend is driven by both the high capital costs of drilling and the anticipated reduction in demand for gas as electric power generation shifts toward renewables and battery storage.

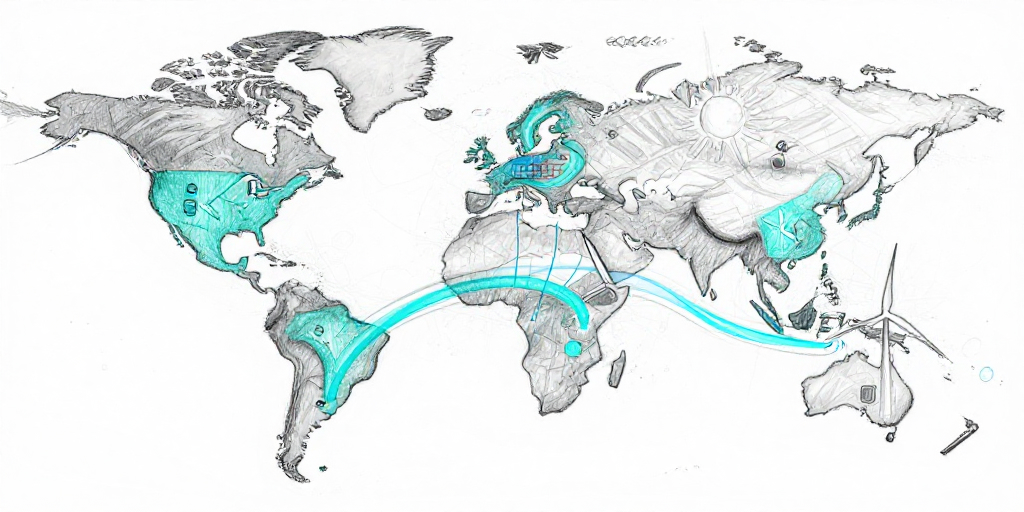

Renewable generation capacity continues to accelerate. Solar photovoltaics and wind power have seen the fastest growth rates over the past two years, with new installations in North America, Europe, and Asia exceeding 200 GW annually. The cumulative capacity of wind and solar now surpasses 1.2 TW, a level that will account for more than 25 % of global electricity generation by 2030. Biomass and geothermal remain niche but are gaining traction in regions where local resources and policy incentives are favorable.

Storage and Grid Modernization

Energy storage is increasingly recognized as a critical component for balancing supply and demand, especially as intermittent renewable resources become more prevalent. Lithium‑ion battery deployments have continued to expand, driven by declining costs and improved performance. In 2026, global battery capacity surpassed 100 GW, with large‑scale utility‑scale projects representing the majority of new installations.

Other storage modalities—pumped hydro, compressed air, and hydrogen—are also receiving attention. Hydrogen, in particular, is emerging as a versatile energy carrier that can store surplus renewable electricity and feed industrial processes, transportation, and power generation. The European Hydrogen Strategy and the United States’ Hydrogen Energy Roadmap have spurred significant investment, with projects ranging from electrolyzers to green hydrogen export terminals.

Grid modernization efforts aim to integrate these storage assets effectively. Smart grid technologies, advanced forecasting, and real‑time demand response are being deployed to reduce curtailment of renewable generation and to ensure reliability. Grid operators are increasingly relying on software‑defined network controls, which allow for faster adaptation to changing generation profiles and consumption patterns.

Regulatory Landscape

Regulatory frameworks continue to evolve to address the twin challenges of decarbonization and grid resilience. In the United States, the Energy Policy Act of 2025 introduced tax incentives for renewable energy and storage projects, while the Inflation Reduction Act expanded clean energy credits to include battery storage and hydrogen production. State‑level mandates, such as California’s Renewable Portfolio Standard, have accelerated the adoption of distributed energy resources and net‑metering reforms.

Internationally, the European Union’s Green Deal and the UK’s Net‑Zero Strategy have set ambitious targets for phasing out fossil fuel subsidies and achieving carbon neutrality by 2050. These policies have led to increased capital flows into renewable projects, particularly offshore wind and solar farms. In China, the 14th Five‑Year Plan emphasizes a shift toward renewable energy and the development of a robust energy storage sector to support the electrification of transportation.

Regulatory uncertainty remains a key risk factor. Changes in political leadership, trade disputes, and shifting policy priorities can alter the trajectory of energy projects. For example, the recent tariff adjustments on imported solar panels in the United States have created uncertainty for supply chains and project timelines. Similarly, geopolitical tensions in the Middle East can influence oil pricing and production decisions, thereby affecting global energy supply dynamics.

Technical and Economic Factors

From a technical perspective, the efficiency of renewable technologies has improved dramatically. Solar panel conversion efficiencies now exceed 22 % for commercial installations, while offshore wind turbines achieve capacities of 14 MW and above. These advances reduce the levelized cost of electricity (LCOE) for renewables, making them competitive with, or cheaper than, conventional power sources in many regions.

Economic factors such as capital costs, operating expenses, and financing terms also shape the energy landscape. The decline in interest rates has lowered the cost of financing new projects, encouraging investment in both renewables and storage. However, supply chain constraints, particularly in battery cathode materials and rare earth elements, have introduced cost volatility.

Traditional energy producers are responding by diversifying their portfolios. Many oil and gas companies are investing in renewable projects, carbon capture and storage (CCS), and green hydrogen. These investments serve both to mitigate regulatory risks and to tap into new revenue streams as the energy transition progresses.

Geopolitical Considerations

Geopolitics continues to influence energy markets in several ways. The ongoing re‑balancing of global trade relations affects the supply of critical minerals needed for renewable technologies. For instance, China’s dominance in rare earth production has prompted the United States and the European Union to accelerate domestic mining and recycling programs.

Oil geopolitics remains a persistent source of market volatility. The 2024 resurgence of sanctions on Russian oil, coupled with the gradual depletion of Russian gas exports to Europe, has shifted supply dynamics. This shift has led to increased interest in liquefied natural gas (LNG) corridors and the development of new export terminals in the United States and the United Arab Emirates.

Renewable energy geopolitics is emerging as well. Countries that possess abundant solar and wind resources, such as Saudi Arabia, Australia, and the United States, are positioning themselves as leaders in global clean energy exports. International cooperation on standards and technology transfer is essential to ensure a smooth transition and to prevent the creation of new geopolitical dependencies.

Conclusion

The energy sector in 2026 is characterized by a complex interplay between production trends, storage technologies, regulatory developments, and geopolitical dynamics. Traditional hydrocarbons continue to dominate the energy mix, but their production is plateauing, while renewable capacity is expanding at a rapid pace. Storage technologies are maturing, providing the flexibility needed to integrate intermittent renewables. Regulatory frameworks are increasingly supportive of decarbonization, yet remain subject to political fluctuations. Finally, geopolitical factors—ranging from supply chain dependencies to resource-rich country strategies—continue to shape market outcomes.

Corporate investors and policymakers must monitor these evolving dynamics closely. Successful navigation of the energy transition will hinge on strategic investments in technology, prudent risk management, and active engagement with regulatory and geopolitical developments.