Power Generation and Utility Systems: Technical and Economic Assessment

Grid Stability in a Transitioning Energy Landscape

The United States transmission grid is undergoing a structural shift from a fossil‑fuel‑dominant architecture to a more distributed and renewable‑rich system. This transition imposes stringent requirements on voltage regulation, frequency control, and fault ride‑through capability. The integration of inverter‑based resources (IBRs) such as rooftop photovoltaics and battery energy storage systems (BESS) introduces power‑factor variability that must be mitigated by advanced wide‑area monitoring and control systems.

Key technical measures include:

- Automatic Generation Control (AGC) upgrades that accommodate the faster response times of modern power electronics.

- Dynamic line rating (DLR) to exploit seasonal and weather‑dependent capacity variations without compromising thermal limits.

- Enhanced synchrophasor networks (PMUs) that provide sub‑second situational awareness, allowing utilities to detect and isolate cascading events before they propagate.

From an economic perspective, the cost of these upgrades is offset by reduced outage durations and the avoidance of costly black‑out mitigation measures. A 2024 study by the National Renewable Energy Laboratory estimated that every $1 million invested in grid‑wide AGC and DLR systems reduces the average outage cost by approximately $15 million over a ten‑year horizon.

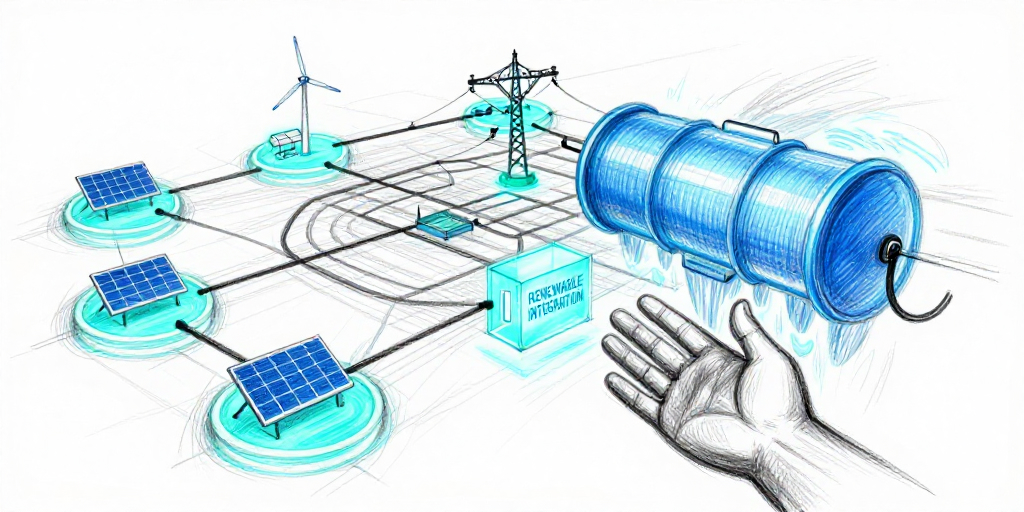

Renewable Integration and Operational Challenges

The penetration of wind and solar resources at or above 30 % of total generation capacity poses significant operational challenges:

- Curtailment Risk – Excess generation during low demand periods often leads to curtailment, reducing revenue streams for renewable developers and undermining investment certainty.

- Ramp Rate Constraints – Conventional thermal plants must be dispatched to balance short‑term fluctuations, increasing wear‑and‑tear and accelerating maintenance schedules.

- Net‑Export Management – In deregulated markets, utilities must negotiate export tariffs and capacity payments that reflect the true value of intermittent resources.

Technological solutions include predictive load forecasting models that incorporate weather data and machine‑learning algorithms, and energy arbitrage via BESS, which shift generation from periods of surplus to periods of scarcity. The economic viability of BESS is improving; the average cost of lithium‑ion storage has fallen 65 % since 2015, making it competitive with traditional peaking plants in many regions.

Regulatory Impacts on Infrastructure Investment

Regulatory frameworks have a decisive influence on the pace and nature of infrastructure investment:

- California’s RPS (Renewable Portfolio Standard) and the Federal Investment Tax Credit (ITC) for solar continue to drive new capacity additions. Utilities must navigate complex interconnection standards and local permitting processes, which can extend project lead times by 12–18 months.

- The Energy Policy Act of 2020 introduced a grid resiliency mandate, requiring utilities to perform vulnerability assessments and invest in hardening assets against extreme weather events.

- State-level net‑metering policies influence the financial models of distributed generation projects. Recent rollbacks in New Hampshire, for instance, have prompted utilities to pursue behind‑the‑meter storage solutions to maintain customer incentives.

The cost‑benefit analysis of these regulatory interventions typically shows a positive net present value (NPV) when factoring in avoided outage costs, improved asset longevity, and enhanced market competitiveness.

Infrastructure Investment Outlook

Capital expenditures (CapEx) in the utility sector are projected to exceed $140 billion over the next five years, with a significant portion earmarked for:

- Grid modernization – Smart grid devices, advanced SCADA, and cyber‑security upgrades.

- Renewable integration – Substation upgrades, HVDC lines, and BESS installations.

- Transmission expansion – New high‑voltage corridors to connect remote wind farms and mitigate congestion.

Financially, the expected return on these investments is bolstered by long‑term rate adjustments approved by public utilities commissions, which allow utilities to recover CapEx over a 20–30 year period. Additionally, green bonds and other sustainability‑linked financing instruments provide favorable terms for projects with demonstrable environmental benefits.

Operational Challenges and Mitigation Strategies

Despite the clear economic rationale, utilities face operational hurdles:

- Cyber‑security threats – The increased digital footprint of modern grids heightens vulnerability. Implementing zero‑trust architectures and continuous monitoring is essential.

- Workforce skill gaps – The shift to digital and renewable technologies necessitates targeted training programs and partnerships with educational institutions.

- Legacy equipment compatibility – Older transformers and protective relays may not support the fast‑response requirements of IBRs, requiring phased replacement programs.

Proactive risk management, including scenario planning and investment in modular, upgradeable equipment, can reduce the likelihood of service interruptions and improve system resilience.

Conclusion

The evolving landscape of power generation and utility systems demands a coordinated technical, economic, and regulatory response. Grid stability is maintained through advanced control systems and real‑time monitoring; renewable integration is facilitated by forecasting tools and storage; and regulatory incentives continue to shape investment decisions. While operational challenges persist, the trajectory of infrastructure development remains favorable, positioning utilities to deliver reliable, low‑carbon energy to the future.