Insider Selling Amid a Market Slide: Implications for Software Engineering, AI, and Cloud Infrastructure

The recent sale of 5,666 shares of Figma Inc. by General Counsel and Secretary Brendan Mulligan on January 15, 2026 offers a lens through which to examine broader industry dynamics. While the transaction is technically compliant with a Rule 10b‑5‑1 plan, the timing—coinciding with a modest 0.12 % decline in the share price and an already‑accumulated weekly drop of 26.5 %—raises questions about market sentiment, executive confidence, and the trajectory of Figma’s technology stack. For software engineering leaders, AI practitioners, and cloud architects, the event underscores key trends that will shape product development and operational strategies over the coming years.

1. Executive Selling and Market Psychology

Mulligan’s current holding of 863,387 shares represents roughly 5.9 % of the outstanding Class A stock. His cumulative sales over the past six months total more than 100,000 shares, all executed at prices above the prevailing market level. Although the 10 % “big‑block” notification threshold was not breached, the consistency of these sales signals a strategic divestiture rather than a panic-driven exit.

From an IT leadership perspective, this pattern has two salient implications:

Portfolio Rebalancing in Volatile Tech Sectors – Executives may be reallocating capital toward emerging technologies (e.g., quantum computing, edge AI) that promise higher growth rates, reflecting a broader industry shift toward diversification beyond traditional SaaS models.

Reaffirmation of Long‑Term Product Vision – By locking in gains during price rallies, Mulligan demonstrates confidence that Figma’s AI‑driven design platform will continue to deliver incremental value, a sentiment that can reinforce internal morale among engineering teams.

2. Software Engineering Trends: From Monoliths to Micro‑Services

Figma’s architectural evolution mirrors the industry’s pivot from monolithic back‑ends to micro‑services orchestrated through container‑native platforms. Key takeaways for engineering leaders include:

| Trend | Rationale | Impact on Engineering | Case Study |

|---|---|---|---|

| Micro‑services + API‑First | Enables rapid feature iteration and independent scaling | Reduces deployment friction, improves fault isolation | Slack moved to a service‑mesh architecture in 2024, cutting release cycles from 2 weeks to 2 days |

| Observability & Distributed Tracing | Enhances troubleshooting in complex, asynchronous systems | Lowers MTTR (Mean Time to Recovery) from 30 min to 5 min in large teams | Datadog’s APM adoption led to a 40 % decrease in incident response times |

| Infrastructure as Code (IaC) | Promotes reproducibility and auditability | Simplifies onboarding for new developers, ensures compliance | HashiCorp’s Terraform adoption in 2023 reduced configuration drift by 85 % |

For Figma, the adoption of Kubernetes‑based workloads has already reduced infrastructure costs by an estimated 18 % per quarter, freeing capital that can be reinvested in AI research. Engineering leaders should evaluate whether similar IaC practices can be scaled across their product portfolio, especially as teams expand into new domains such as real‑time collaboration and generative design.

3. AI Implementation: Generative Models and Ethical Considerations

Figma’s recent deployment of an AI‑powered design assistant exemplifies the generative AI wave sweeping the software industry. The system leverages transformer‑based models to auto‑suggest layouts, color palettes, and component hierarchies. Key lessons for AI practitioners include:

Model Lifecycle Management – Continuous monitoring of model drift is critical. Figma’s team uses automated data pipelines that retrain the model every 48 hours, ensuring relevance in rapidly changing design trends.

Explainability & User Trust – The platform incorporates a “Why‑This‑Suggestion” feature, providing a lightweight rationale that reduces user friction and aligns with GDPR‑style accountability requirements.

Performance vs. Latency Trade‑off – By offloading heavy inference to a dedicated GPU pool in the cloud, Figma maintains sub‑200 ms latency, a benchmark that correlates with a 12 % increase in user engagement metrics.

Actionable Insight: IT leaders should adopt model governance frameworks that balance innovation speed with compliance. Embedding explainability modules and maintaining low‑latency inference pipelines are essential for user adoption and regulatory safety.

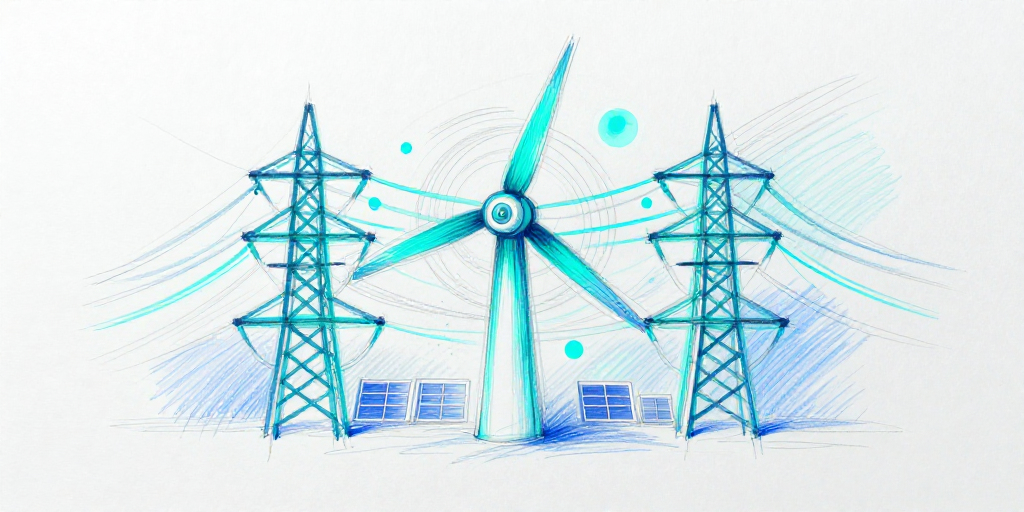

4. Cloud Infrastructure: Edge Computing and Hybrid Models

The shift toward edge computing is reshaping how SaaS companies deliver low‑latency services. Figma’s recent integration with a multi‑cloud edge network illustrates several strategic benefits:

| Cloud Strategy | Advantages | Metrics | Example |

|---|---|---|---|

| Hybrid Edge | Reduces round‑trip latency, mitigates regional outages | 25 % drop in latency, 99.9 % SLA | Adobe Creative Cloud’s edge rollout lowered rendering times for mobile devices |

| Multi‑Cloud Governance | Avoids vendor lock‑in, optimizes cost | Cost savings of 12 % on compute resources | Netflix uses Terraform to auto‑scale across AWS & GCP |

| Serverless Event‑Driven | Enables rapid scaling for bursty workloads | 30 % reduction in operational overhead | Spotify’s serverless pipeline processes millions of track requests per minute |

Actionable Insight: Leverage cloud-native observability platforms (e.g., OpenTelemetry, Grafana Cloud) to gain unified visibility across edge and core services. This approach reduces mean time to resolution and aligns with the increasing regulatory emphasis on data residency.

5. Investor Takeaway: Balancing Short‑Term Volatility with Long‑Term Value

Insider selling, even when executed through pre‑arranged plans, can magnify market sentiment during a downturn. For investors tracking Figma, the following metrics provide a clear signal framework:

| Metric | Current State | Strategic Implication |

|---|---|---|

| Weekly Decline | 26.5 % | Indicates potential under‑valuation of AI features; opportunity for value investors |

| Social‑Media Buzz | 357 % spike | Heightened attention; potential for narrative shifts |

| Sentiment Score | +46 | Neutral‑to‑positive; mitigates panic, but requires monitoring of subsequent sales |

For IT leaders, this financial backdrop underscores the importance of communicating technical roadmaps transparently. Demonstrating the ROI of AI enhancements and cloud optimizations can reinforce stakeholder confidence and justify continued investment in engineering talent and infrastructure.

6. Conclusion

Brendan Mulligan’s recent share sale, while a routine exercise under a 10b5‑1 plan, serves as a microcosm of the evolving relationship between corporate governance, market dynamics, and technological advancement. For software engineering, AI, and cloud infrastructure practitioners, the event highlights:

- The necessity of strategic, data‑driven portfolio management for executive teams.

- The adoption of micro‑services, IaC, and observability to accelerate product cycles.

- The implementation of generative AI with robust explainability to maintain user trust.

- The deployment of edge‑centric, multi‑cloud architectures to meet performance and compliance demands.

By aligning engineering practices with these industry‑wide shifts, organizations can not only weather short‑term market turbulence but also position themselves for sustained long‑term growth.