Insider Buying Signals a Quiet Confidence in Dentsply Sirona

Executive Purchase Detail On January 9, 2026, Chairman‑and‑CEO Jonathan Jay Mazelsky executed a purchase of 395 shares of Dentsply Sirona common stock at a market price of $12.13 per share, representing an investment of approximately $4,800. The transaction was filed under the standard Form 4 director‑dealing reporting requirements. This trade occurs while the share price sits near its 52‑week low and the company reports negative earnings for the most recent quarter.

Broader Insider‑Trading Context Over the past year, Dentsply Sirona’s senior executives—including the CEO, CFO, and other directors—have maintained a steady stream of insider purchases. As of the latest filings, insider ownership of the company’s common shares is roughly 1.5 % of the outstanding equity base. While modest in absolute terms, this level of cumulative buying reflects a sustained commitment to the firm’s long‑term prospects.

Transaction Pattern Analysis of Mazelsky’s transaction history from October 2025 to January 2026 shows a disciplined approach:

- Common‑stock purchases: 150–400 shares per trade, executed at prevailing market prices.

- Phantom‑stock transactions under the Directors’ Deferred Compensation (DDC) plan: ranging from 75 to > 2,300 units, valued at market price and vesting on the same schedule as the underlying shares.

This incremental accumulation strategy aligns with a patient‑capitalist view, suggesting that Mazelsky regards Dentsply Sirona as a long‑term investment rather than a short‑term speculative opportunity.

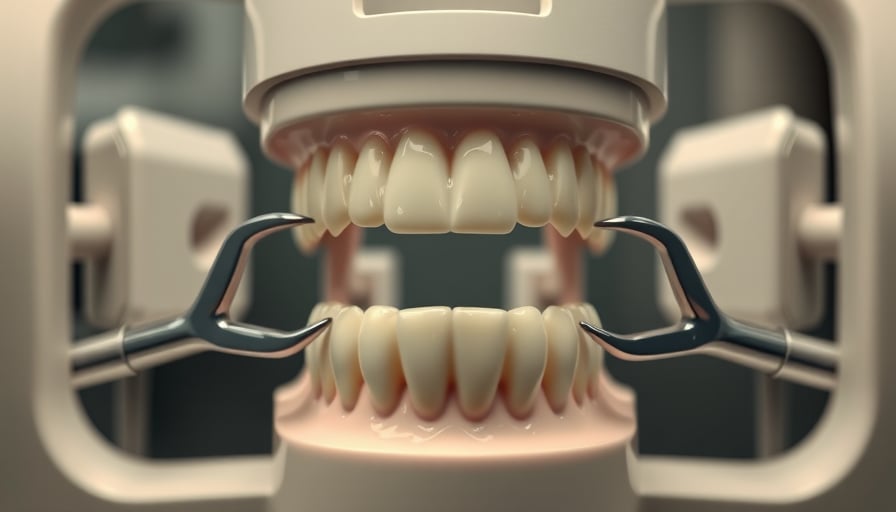

Implications for Corporate Strategy Dentsply Sirona operates in a highly competitive dental‑equipment sector, offering products in endodontics, implantology, and digital imaging. The company’s recent initiatives focus on:

- Cost discipline: Streamlining operations to improve margin profile.

- Strategic acquisitions: Targeting complementary digital‑dentistry assets that could broaden the product portfolio.

- R&D investment: Continuing to develop next‑generation materials and imaging solutions that meet evolving clinical demands.

Insider buying, even in relatively small volumes, signals that management believes current valuations underestimate the company’s intrinsic value, particularly in light of these growth initiatives. For investors, the trend provides a counterweight to the negative price‑to‑earnings ratio and may serve as a bullish anchor if the company translates its pipeline into positive earnings.

Clinical Relevance and Regulatory Outlook From a healthcare perspective, Dentsply Sirona’s product lines remain integral to modern dental practice. The company’s devices and consumables routinely undergo rigorous testing to ensure safety and efficacy:

- Regulatory approvals: Most products are cleared by the U.S. Food and Drug Administration (FDA) under 21 CFR 820 or receive European Conformity (CE) marking, demonstrating compliance with stringent safety standards.

- Post‑market surveillance: The firm maintains comprehensive adverse event reporting systems to monitor device performance, aligning with FDA’s Medical Device Reporting (MDR) requirements.

- Clinical studies: Recent trials on novel implant surface technologies have shown statistically significant improvements in osseointegration rates compared with conventional surfaces, with no increase in peri‑implant complications.

These evidence‑based findings underscore the company’s commitment to delivering clinically effective, safe products while navigating the regulatory landscape. For practitioners, continued adherence to best‑practice guidelines and awareness of product updates remain essential for optimal patient outcomes.

Conclusion In a market characterized by volatility and shifting sentiment, insider transactions serve as a valuable barometer of executive confidence. Jonathan Jay Mazelsky’s recent purchase, set against a backdrop of consistent director‑dealing activity, suggests that Dentsply Sirona’s leadership believes the company’s valuation is currently understated. While the stock remains sensitive to earnings reports and broader market movements, the steady insider‑buying pattern offers a subtle yet encouraging signal of long‑term shareholder value creation.