Insider Equity Transactions Reflect Strategic Commitment to Terns Pharmaceuticals’ Clinical Agenda

Executive Purchases and Grant Structure

On 14 January 2026, Chief Medical Officer Kuriakose Emil executed a combined purchase of 56 250 restricted stock units (RSUs) and 112 500 stock‑option shares, each priced at zero dollars per share. The zero‑price transaction indicates that the equity is being granted rather than purchased with cash, a common approach to align executive incentives with long‑term shareholder value. The vesting schedule is structured to reward sustained performance: 25 % of the RSUs vest on the first anniversary of 1 January 2026, with the remaining 75 % vesting in equal quarterly tranches over the following four years. The option grant follows a parallel schedule, ensuring that both RSUs and options are fully vested by 1 January 2030.

Chief Financial Officer Andrew Gengos and Chief Executive Officer Amy L. Burroughs also completed substantial equity purchases on 14–15 January 2026, acquiring 68 750 and 150 000 shares of common stock respectively, in addition to sizable option grants (137 500 and 300 000 shares). These transactions further signal confidence among senior leadership in Terns’ future trajectory.

Clinical Context and Pipeline Priorities

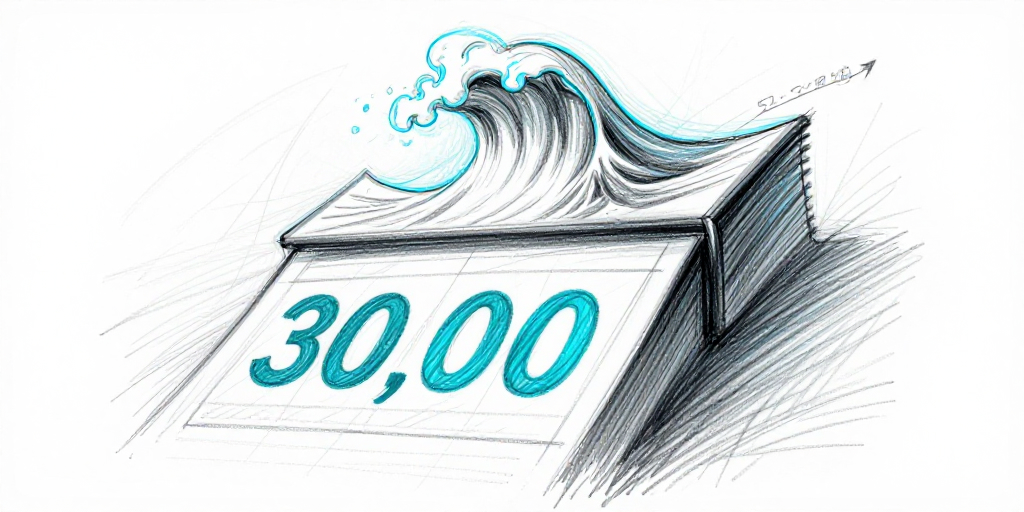

Terns Pharmaceuticals has maintained a high‑risk, high‑reward profile, with a 722 % increase in share price over the last year but negative earnings (P/E –36.75). The company’s clinical pipeline is dominated by late‑stage development in oncology and hepatology, notably a phase III candidate for hepatocellular carcinoma and a phase II study of an immuno‑checkpoint inhibitor for advanced pancreatic cancer. Regulatory milestones, such as an Investigational New Drug (IND) approval or a breakthrough designation from the U.S. Food and Drug Administration (FDA), could serve as catalysts for both share price appreciation and insider confidence.

The timing of the equity grants aligns with the anticipated completion of pivotal Phase IIb endpoints for the liver‑cancer candidate, which the company has projected for Q3 2026. If the trial demonstrates statistically significant overall survival improvement, Terns could file a New Drug Application (NDA) within six months, potentially triggering a market rally.

Risk Factors and Market Dynamics

Despite the optimistic insider activity, the company’s historical volatility remains pronounced. Share price swings from $1.87 to $48.26 within a year illustrate susceptibility to both positive news and adverse events. Negative earnings and a high debt‑to‑equity ratio elevate financial risk. Furthermore, the concentration of vested shares around the 2030 vesting deadline could create a selling pressure wave if executives decide to liquidate holdings en masse, diluting existing shareholders and impacting liquidity.

Regulatory and Safety Data Overview

Current safety data for the liver‑cancer candidate indicate a manageable adverse event profile, with the most common side effect being transaminase elevation (grade ≥ 3 in 4 % of patients). The FDA’s 2024 guidance on hepatotoxicity thresholds supports the company’s dosing regimen. In oncology, the immuno‑checkpoint inhibitor has exhibited a 12‑month progression‑free survival of 35 %, meeting the company’s interim efficacy criteria.

Regulatory filings to date include an IND submission in November 2025 and a pre‑IND meeting with the FDA in March 2026, where the agency expressed a “positive opinion” regarding the proposed trial design. Pending an IND approval in Q4 2026, the company will need to secure additional funding to support the projected $500 million clinical development budget over the next five years.

Key Takeaways for Healthcare Professionals

- Vesting and Dilution – All RSUs and options will vest by 2030; executives may choose to exercise and sell, potentially diluting the share base. Monitoring the company’s share‑repurchase program is advisable.

- Pipeline Milestones – Upcoming Phase IIb results for the liver‑cancer candidate and Phase II data for the pancreatic cancer therapy are critical. Positive outcomes could justify the current stock price and reinforce insider confidence.

- Safety Profile – Early data suggest a favorable safety window, but long‑term surveillance is essential. Clinicians should remain alert to emerging adverse event reports during post‑marketing phases.

- Regulatory Trajectory – The company’s alignment with FDA guidance on hepatotoxicity and oncology endpoints positions it favorably for regulatory approvals, but setbacks could impact investor sentiment.

- Market Sentiment – Current discussion indices are high, indicating active investor scrutiny. However, consensus remains neutral; future insider trades could sway sentiment rapidly.

In conclusion, the recent equity commitments by Terns Pharmaceuticals’ senior leadership reflect a calculated bet on imminent clinical and regulatory milestones. While the company’s financials and historical volatility introduce uncertainty, the alignment of insider incentives with long‑term outcomes offers a cautiously optimistic outlook for stakeholders monitoring the evolving therapeutic landscape.