Insider Sale by Katmandu Ventures, LLC in Falcon’s Beyond Global

Transaction Overview

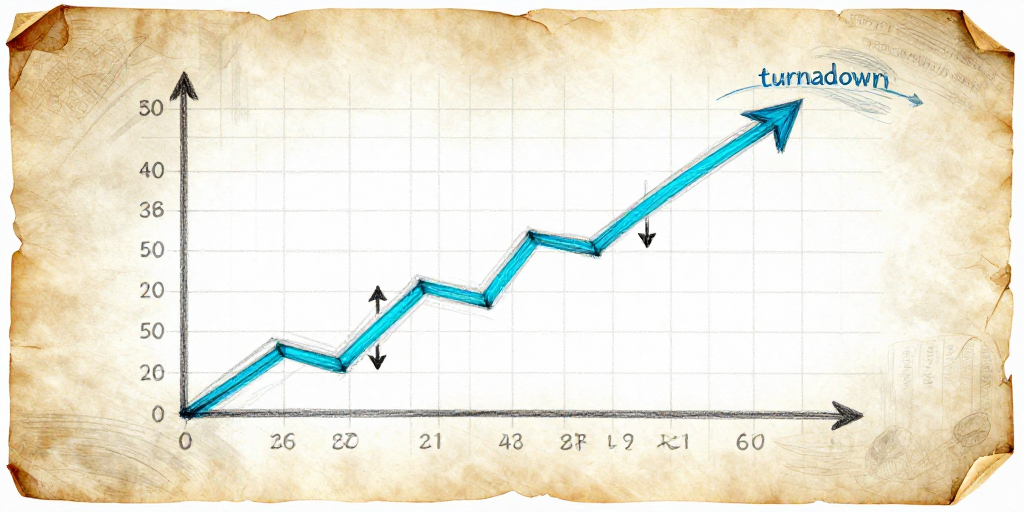

On January 12, 2026, Katmandu Ventures, LLC liquidated 691,563 shares of Falcon’s Beyond Global’s Class A common stock at a price of $7.23 per share, slightly below the market valuation of $7.44. The sale reduced Katmandu’s stake to 1.75 million shares, representing roughly 42 % of the holding prior to the transaction. The transaction price, while marginally lower than the trading price, occurred in a market context marked by significant downside: the share price was 43 % below its 52‑week high and 39 % below its most recent monthly high. Falcon’s current price‑earnings ratio of 654.14 signals escalating valuation pressures.

Market Dynamics

- Valuation Environment

- The extraordinarily high P/E ratio reflects heightened expectations for future growth, yet the current price decline indicates market skepticism.

- Volatility is amplified by the company’s mixed performance across theme‑park, gaming, and animation segments, each of which has responded differently to post‑pandemic consumer behavior.

- Liquidity Considerations

- The sale’s size relative to daily trading volume is modest; the share price dipped only 0.13 % on the day, underscoring a shallow immediate impact.

- However, cumulative insider activity (alternating purchases and disposals over the past 12 months) suggests an active liquidity strategy rather than panic selling.

- Capital Allocation Trends

- Katmandu’s pattern of large, one‑time disposals aligns with a portfolio rebalancing strategy aimed at reallocating capital to other opportunities.

- The proceeds may be earmarked for diversification or for funding Falcon’s potential digital expansion initiatives.

Competitive Positioning

Sector Landscape Falcon’s Beyond Global operates at the intersection of theme parks, gaming, and animation.

Theme Parks: Intense competition from established operators such as Disney and Universal, compounded by shifting consumer preferences toward virtual experiences.

Gaming & Animation: Rapid technological evolution and intellectual property (IP) battles with major studios and emerging indie developers.

Strategic Opportunities

The company’s 31 % revenue growth in 2026, despite volatility, indicates resilience and a capacity for scaling profitable segments.

An insider sale freeing capital could enable strategic acquisitions of complementary IP or investment in proprietary digital platforms, potentially enhancing competitive differentiation.

Economic Factors

Consumer Spending Patterns Post‑pandemic recovery has seen a resurgence of discretionary spending on entertainment, yet the shift toward remote and digital consumption moderates growth prospects for physical attractions.

Interest Rate Environment Rising borrowing costs could constrain capital expenditures for large theme‑park projects, making efficient use of existing capital—through strategic disposals—more critical.

Regulatory Considerations Heightened scrutiny of insider trading and corporate governance may influence investor perception, but the current transaction did not trigger significant regulatory or market reactions.

Implications for Investors

| Aspect | Assessment |

|---|---|

| Short‑term Market Impact | Minimal price movement; neutral sentiment; negligible effect on day‑to‑day trading activity. |

| Long‑term Strategic Effect | Potentially enhances Falcon’s capacity to invest in digital growth or acquire strategic IP; may improve long‑term value if executed effectively. |

| Risk Profile | Persisting market volatility and sector‑specific challenges; continued sensitivity to consumer preference shifts. |

Recommendations for Portfolio Management

Monitor Katmandu Filings Future disclosure of capital redeployments can signal strategic shifts in Falcon’s operational focus or broader investment trends.

Assess Falcon’s Earnings Guidance Updated forecasts will clarify whether the company is pursuing a digital pivot or a return to traditional physical attractions, informing valuation models.

Evaluate Competitive Moves Keep abreast of acquisitions or partnerships within the theme‑park, gaming, and animation arenas that could alter Falcon’s competitive landscape.

Prepared for institutional investors seeking a concise, data‑driven analysis of recent insider activity and its potential ramifications for Falcon’s Beyond Global.