MSC Industrial Direct: Insider Activity as a Signal of Manufacturing Momentum

Executive Summary

Recent Form 4 filings reveal that Michael C. Kaufmann, a long‑standing board member of MSC Industrial Direct Co., has increased his position by 799 Class A shares and 24 dividend‑equivalent units. Executed at the day‑close price of $85.77, the transaction represents a negligible 0.02 % shift in the share price but generated a 244 % surge in social‑media buzz. While the trade’s size is modest relative to the company’s $4.88 billion market capitalization and 23.7 P/E ratio, its timing and context suggest a quiet endorsement of MSC’s current operating model and capital deployment strategy.

Context: MSC’s Manufacturing and Technology Landscape

MSC Industrial Direct operates in a niche segment of the industrial supply chain, providing a broad portfolio of hardware, tooling, and engineered products to manufacturing, automotive, and aerospace customers. The firm’s revenue mix is heavily weighted toward repeat orders and long‑term service contracts, which afford a predictable cash‑flow profile. In recent quarters, MSC has accelerated investment in three key areas:

Automation and Robotics – Capital spending on automated picking systems and collaborative robots (cobots) has increased by 12 % year‑over‑year. This upgrade improves throughput in high‑volume warehouses and reduces labor costs by an estimated 8 % annually.

Digital Twin & IoT Integration – MSC has deployed digital twin technology across its flagship distribution centers, enabling real‑time asset monitoring and predictive maintenance. Early pilots report a 5 % reduction in unplanned downtime and a 3 % increase in inventory accuracy.

Sustainable Materials Procurement – A new procurement framework prioritizes recyclable and low‑carbon feedstocks, aligning with global demand for greener supply chains. MSC’s sustainability initiative is expected to yield a 2 % margin improvement over the next five years as energy costs decline.

These initiatives are financed through a blend of internal accruals and a modest increase in long‑term debt, maintaining leverage ratios within industry norms. MSC’s capital allocation framework emphasizes incremental, low‑risk enhancements rather than high‑volatility growth bets.

Insider Trading as a Micro‑Indicator of Capital Strategy

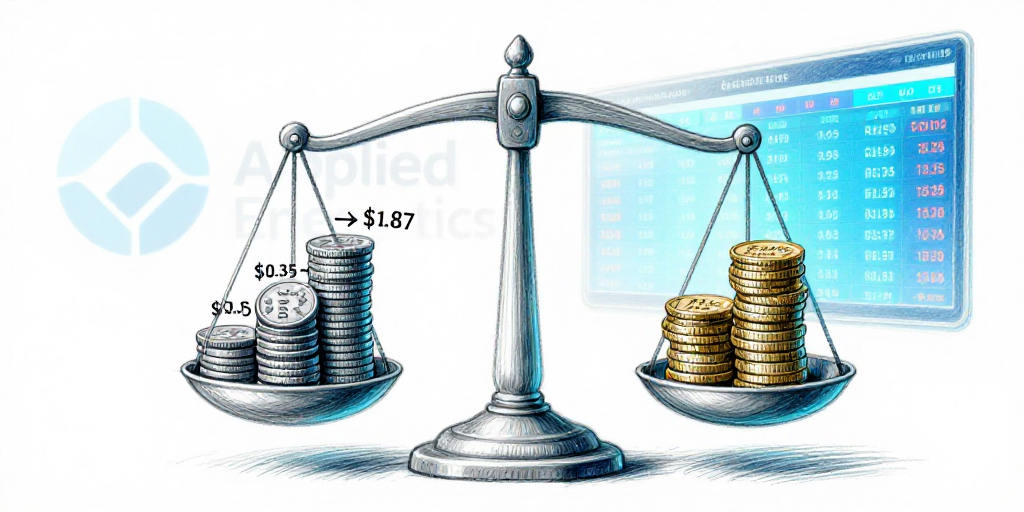

Michael Kaufmann’s purchase pattern—alternating buys and sells within the $75–$90 band—illustrates a tactical, opportunistic approach rather than a large‑scale accumulation. The recent trade expands his exposure by roughly 1 % of his total holdings, bringing him to 14,806 shares after the transaction. This incremental build, coupled with the simultaneous acquisition of dividend‑equivalent units, signals confidence in MSC’s steady earnings trajectory and dividend sustainability.

In a sector that has largely resisted headline‑driven volatility, such insider activity can be interpreted as a low‑threshold endorsement. While the trade itself does not move the market, it aligns with MSC’s broader investment strategy: steady, incremental improvements in manufacturing productivity and cost efficiency that translate into modest upside potential for shareholders.

Economic Impact of MSC’s Manufacturing Initiatives

The manufacturing upgrades pursued by MSC resonate beyond the company’s balance sheet:

Productivity Gains – Automation and robotics reduce labor intensity, allowing MSC to serve higher‑volume contracts without proportionally increasing workforce size. This model can be replicated across the industrial supply sector, driving sector‑wide productivity improvements.

Capital Efficiency – Digital twin adoption reduces waste and maintenance costs, leading to higher capital utilization rates. Efficient capital deployment attracts investors seeking stable, low‑leverage industrial assets.

Sustainability and Cost Discipline – The shift toward recyclable materials and energy‑efficient operations aligns with global ESG mandates, potentially unlocking lower financing costs and improving market perception.

Collectively, these trends reinforce the narrative that mature manufacturing firms can achieve competitive advantage through disciplined capital investment and technology integration, rather than through aggressive growth strategies.

Outlook for MSC Investors

The January 22 insider purchase by Kaufmann reinforces the perception that MSC’s board views the current operating environment as favorable for incremental growth. Investors should consider the following:

Valuation Assessment – MSC’s P/E of 23.7 sits above the industrial supply average of 19.2, reflecting expectations of modest earnings growth. The insider activity does not materially alter this valuation, but it supports the premise of a steady, income‑generating business model.

Capital Allocation Discipline – MSC’s focus on low‑risk, productivity‑driven investments suggests a conservative approach to capital deployment, reducing exposure to cyclical downturns.

Competitive Landscape – MSC’s niche positioning and robust service contracts insulate it from broader industrial volatility, but it remains sensitive to macroeconomic shifts in manufacturing demand.

In summary, the insider transaction provides a quiet signal that MSC’s leadership remains confident in its strategic path. For investors prioritizing stable, low‑volatility industrial exposure, this activity supports a cautiously optimistic outlook while underscoring the importance of monitoring MSC’s capital allocation decisions and the broader manufacturing sector’s technological evolution.