Insider Selling Amid Cloud‑Growth Hype and Debt‑Looming Litigation

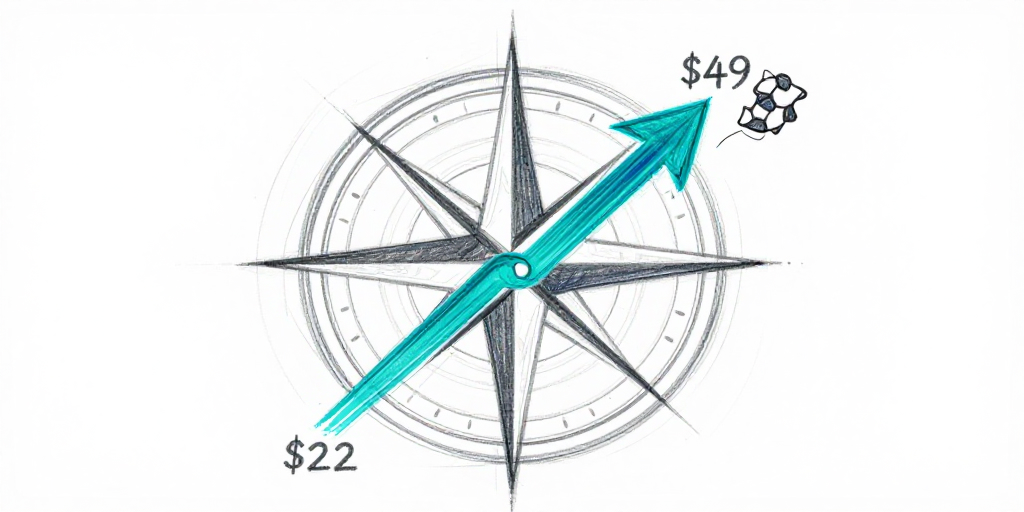

Oracle Corporation’s recent insider transaction, executed on January 15 by Executive Vice President (EVP) Kehring Douglas A, involved the sale of 35,000 shares of common stock at $194.89 per share under a Rule 10b5‑1 plan. The sale occurred while the stock was trading near a 52‑week high of $345.72, a price point that underscored the company’s valuation resilience in the face of mounting legal scrutiny. Although the transaction represented a modest fraction of Oracle’s $545 billion market capitalization, it signals that even senior leadership is trimming positions as the firm confronts a high‑profile debt‑raising lawsuit. Market data for the day recorded a 0.01 % price change, indicating that the sale did not materially move the stock; however, social‑media activity surged by 124 %, reflecting heightened retail attention.

Market Dynamics and Insider Activity

The sale of Kehring’s shares is part of a broader trend of conservative insider divestiture observed over the past year. Prior to the transaction, Kehring held 60,700 restricted shares, which were reduced to 33,638 following the sale. Other Oracle executives—President Hura Mark and Vice Chairman Jeffrey Henley—have likewise liquidated sizable blocks, contributing to a cumulative insider selling pressure. When combined with the bondholder lawsuit alleging concealed debt expansion, the narrative may reinforce bearish sentiment among investors, especially given the already pressured share price.

Conversely, Oracle’s cloud and artificial‑intelligence (AI) order books remain robust. The company has reported significant growth in its cloud services segment, driven by a surge in demand for data‑centric and AI‑enabled solutions. This core business momentum suggests that long‑term growth prospects remain intact, despite short‑term liquidity concerns arising from insider selling and litigation risk.

Competitive Positioning in the Cloud Sector

Oracle competes with major cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform. Its differentiation strategy focuses on hybrid‑cloud integration, data‑management expertise, and industry‑specific solutions. The recent expansion of its AI capabilities—through acquisitions of data‑science startups and the integration of generative‑AI models—positions Oracle to capture a larger share of the enterprise AI market. However, the company’s market share growth has been tempered by intense pricing pressure and the need to accelerate innovation cycles to keep pace with competitors.

Economic Factors and Litigation Risk

The debt‑raising lawsuit alleges that Oracle engaged in undisclosed debt expansion, potentially impacting the company’s capital structure and credit metrics. If substantiated, the litigation could lead to additional debt covenants, higher interest costs, or a reassessment of the company’s risk profile by rating agencies. Such outcomes would likely increase the perceived risk premium demanded by investors, compressing share price appreciation prospects.

From a macroeconomic perspective, the broader technology sector is experiencing a slowdown in capital expenditure budgets as enterprises adopt more conservative spending models in the post‑pandemic environment. Oracle’s ability to convert its cloud and AI offerings into recurring revenue streams will be pivotal in maintaining shareholder value amid tightening discretionary budgets.

Implications for Investors

For portfolio managers and retail investors, Kehring’s sale highlights the following considerations:

Short‑Term Liquidity Pressure – Insider selling can create a perception of impending volatility, but the lack of a significant price impact suggests that market liquidity remains sufficient.

Long‑Term Fundamentals – Oracle’s cloud and AI pipeline continues to generate substantial revenue growth, reinforcing the case for a bullish stance contingent upon litigation outcomes.

Risk Management – Investors should monitor regulatory filings, court proceedings, and Oracle’s disclosures related to its debt strategy to assess the potential materiality of the lawsuit.

Portfolio Rebalancing – The sale may reflect a broader trend of diversification among senior executives, indicating that institutional portfolios may also be rebalancing exposure to high‑growth technology stocks.

In summary, Oracle’s insider transaction underscores the delicate balance between capital market sentiment and core business momentum. While the debt‑related lawsuit introduces a layer of uncertainty, the company’s continued investment in cloud and AI capabilities provides a foundation for sustained long‑term growth, provided that litigation risks are adequately priced into the equity valuation.