Insider Selling at Rapid 7: What It Means for Shareholders

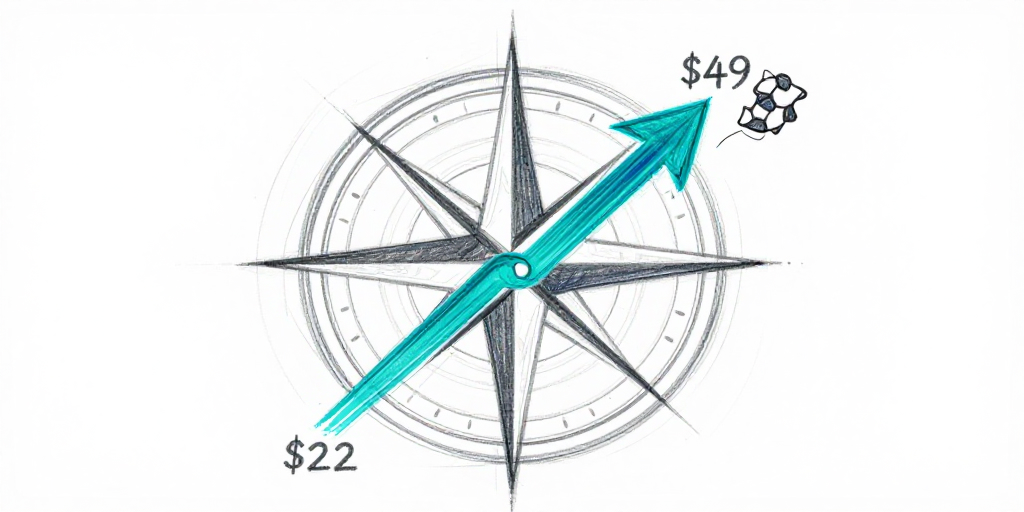

The recent divestiture by Murphy Scott M., Rapid 7’s Chief Accounting Officer, illustrates a broader pattern of insider activity that has unfolded over the past eighteen months. On 15 January 2026, Scott sold 406 shares of Rapid 7 common stock at $13.30 per share, a price only slightly below the preceding day’s close. Although this transaction represents a modest portion of the company’s market capitalization of $885 million, it is part of a cumulative sale of more than 10 000 shares since February 2025, reducing Scott’s holding from 37 254 shares at the beginning of 2025 to 24 076 after the most recent trade.

A Quiet Trend of Divestiture

The timing of Scott’s sale is noteworthy. Rapid 7’s share price has declined 19 % year‑to‑date, and its 52‑week high now lies below the low recorded in 2025. The company’s Q4 2025 results are pending, and market sentiment has priced in an expected 10 % drop in the coming week, underscoring persistent investor scepticism. While Scott’s single trade is unlikely to move the market, it joins a wave of insider transactions that includes CEO Thomas Corey, who purchased 200 000 shares in December 2025 and sold 182 321 shares just fifteen days later. This juxtaposition of buying and selling among senior executives suggests a short‑term tactical approach rather than a long‑term strategic shift.

Implications for Investors

From an investor’s perspective, Scott’s consistent selling may indicate that he perceives Rapid 7’s valuation to have peaked. However, the shares he sells are likely “restricted” or “vested” units, which can only be liquidated when tax‑withholding obligations are satisfied. This administrative trigger is common for insiders holding large restricted‑stock award pools and does not necessarily reflect an intentional market move. Nonetheless, cumulative insider sell‑offs can reinforce a bearish narrative, particularly when combined with the company’s weak quarterly momentum and a price‑to‑earnings ratio of 39.2—well above the IT sector average.

Profile: Murphy Scott M.

Scott joined Rapid 7’s board in 2023 and has since been a frequent participant in insider filings. His sales began with a 23 280‑share purchase in February 2025, followed by a series of sell orders that peaked in August 2025 (5 461 shares) and have tapered to 406 shares in January 2026. The average price per share in his sell transactions has hovered around $18–$21, indicating he is selling near market value. His activity is consistent with a typical accounting‑chief profile: periodic divestiture of restricted shares tied to vesting schedules rather than opportunistic trades. His shareholding remains above 24 000, a meaningful position but below the thresholds that trigger significant market commentary.

What Comes Next?

Rapid 7’s upcoming Q4 2025 earnings will be a key event for all stakeholders. If the company delivers stronger revenue growth or a better‑than‑expected margin, it could dampen insider selling or even prompt new purchases. Conversely, a weak report could accelerate the trend, especially as the stock continues its slide. For investors, monitoring Scott’s and other insiders’ trading patterns provides a useful barometer of confidence, but they should also weigh the broader fundamentals—Rapid 7’s cloud‑security partnership, its 2025 revenue guidance, and the cyclical nature of the cybersecurity industry—before making decisions.

| Date | Owner | Transaction Type | Shares | Price per Share | Security |

|---|---|---|---|---|---|

| 2026‑01‑15 | Murphy Scott M. (Chief Accounting Officer) | Sell | 406.00 | 13.30 | COMMON STOCK |

Broader Context: Regulatory Environments, Market Fundamentals, and Competitive Landscapes

Regulatory Landscape

The cybersecurity sector operates under a tightening regulatory framework. In the United States, the Federal Trade Commission’s data‑breach notification rules and the General Data Protection Regulation in the European Union impose significant compliance costs on vendors. Rapid 7’s recent filings indicate a proactive stance on privacy and data protection, which may shield it from fines but also increase operational overhead. Moreover, the evolving U.S. National Institute of Standards and Technology (NIST) cybersecurity framework is driving demand for advanced threat detection platforms—an area where Rapid 7 has historically positioned itself.

Market Fundamentals

Rapid 7’s revenue has grown at a compound annual growth rate (CAGR) of 15 % over the past three fiscal years, driven largely by its Secure‑Analytics suite. However, the company’s gross margin has stagnated at approximately 70 %, reflecting increased spending on research and development and competitive pricing pressures. The current price‑to‑earnings ratio of 39.2, compared to the broader IT sector average of 23.7, signals that investors are pricing in substantial upside, yet the risk of over‑valuation remains. Analysts note that the company’s cash burn is moderate, and its free‑cash‑flow generation has improved in the last quarter, which could alleviate some of the valuation concerns.

Competitive Landscape

Rapid 7 faces stiff competition from both incumbents and emerging startups. Established players such as CrowdStrike, Palo Alto Networks, and Microsoft Azure Security Center offer integrated threat‑intelligence solutions that appeal to large enterprise clients. Startups like SentinelOne and Sumo Logic are gaining traction with cloud‑native, AI‑driven detection capabilities. Rapid 7’s differentiation lies in its open‑platform approach, allowing customers to integrate third‑party data sources. Nonetheless, the market is increasingly consolidating, and Rapid 7’s ability to maintain market share will depend on continued innovation and strategic partnerships.

Hidden Trends, Risks, and Opportunities

| Hidden Trend | Risk | Opportunity |

|---|---|---|

| Shift to Cloud‑Native Security | Rapid 7 may lag if it fails to accelerate its cloud‑first offerings. | Investing in AI‑driven analytics can capture emerging demand. |

| Regulatory Pressure on Data Privacy | Non‑compliance could lead to fines and reputational damage. | Proactive compliance can become a competitive advantage. |

| Increasing Customer Demand for Integration | Dependence on legacy integrations may limit growth. | Building an open API ecosystem could broaden customer base. |

| Potential for Strategic M&A | Rapid 7 may be an acquisition target in a consolidating market. | Strategic acquisitions could fill technology gaps. |

This article synthesizes insider trading activity with broader market dynamics to provide investors with a comprehensive view of Rapid 7’s current position and future prospects.