Insider Activity at Serve Robotics: A Microcosm of Executive Cash‑Out Patterns in the Consumer‑Goods Ecosystem

The February 3, 2026 filing reveals that Serve Robotics’ Chief Financial Officer, Read Brian, sold 1,547 shares of the company’s common stock at an average price of $10.83. This transaction, driven by the tax‑withholding requirements associated with the vesting of restricted‑stock units (RSUs), aligns with a broader pattern of routine liquidity events that have become a hallmark of the firm’s insider activity over the past 12 months.

Routine Transactions, Not a Sign of Dissent

When placed in a historical context, the CFO’s recent sales represent a continuation of a volume‑driven strategy. Over the preceding year, Read Brian has liquidated roughly 27 000 shares, with a net average sale price oscillating between $11 and $13. The most recent sale on December 31, 2025—1,863 shares at $10.37—mirrors the February 2026 transaction in both quantity and price range. These outflows typically occur at market close following RSU vesting dates and lack the volatility that would signal a strategic pivot or loss of confidence in the company’s trajectory.

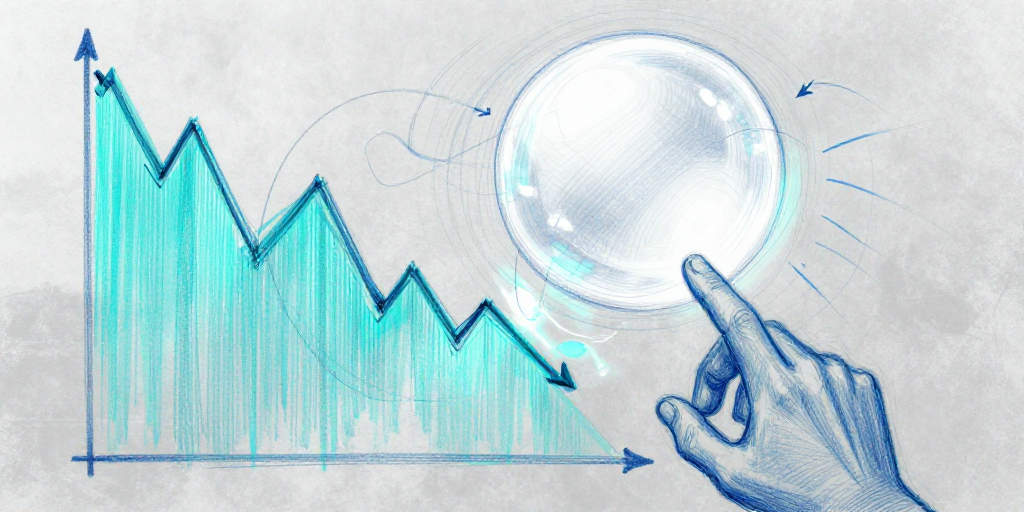

Market‑Wide Implications of Shareholder Sentiment

Serve Robotics’ share price, which closed at $10.16 on the filing date, has experienced a sharp decline: an 18.7 % drop from the previous week and a 29.9 % drop from the month’s high. Coupled with a negative price‑to‑earnings ratio of –9.3, the firm remains unprofitable, and its valuation sits modestly above book value. While the CFO’s trades are routine, the frequent sell‑offs can amplify market perception of risk, especially when the underlying financial metrics remain weak. Investors may interpret the pattern as an implicit acknowledgment that senior management is not betting on a short‑term rebound, even if the transactions themselves are purely administrative.

Cross‑Sector Patterns in Executive Equity Management

The Serve Robotics case is emblematic of broader trends in the consumer‑goods and retail sectors. Executives across these industries frequently liquidate RSU holdings to:

- Mitigate tax exposure – RSU vesting events trigger significant withholding taxes; selling shares immediately post‑vest mitigates cash‑flow constraints.

- Rebalance portfolios – Maintaining a diversified personal portfolio requires periodic liquidation of equity awards.

- Signal long‑term confidence – Holding substantial shares over time (Read Brian’s holdings have fluctuated between 200 000 and 380 000 shares) indicates a commitment to the company’s long‑term prospects, even if short‑term trades occur.

These practices are consistent across companies that operate in highly competitive, rapidly evolving consumer‑goods landscapes where brand differentiation and supply‑chain agility are paramount.

Brand Strategy and Investor Perception

From a brand‑strategy standpoint, frequent insider selling can influence external narratives about a company’s stability. Retail investors often use insider activity as a proxy for management confidence. In sectors where consumer loyalty is built on brand equity, any signal—intentional or not—that senior leadership is not fully invested can erode brand credibility. Conversely, executives who maintain significant holdings and disclose clear tax‑management rationales can reinforce a narrative of disciplined financial stewardship, thereby supporting brand trust.

Innovation Opportunities and Market Shifts

The current volatility presents a window of opportunity for Serve Robotics to:

- Accelerate product differentiation – By investing in unique automation solutions for the hospitality and retail markets, the firm can create a defensible niche that justifies higher valuation multiples.

- Leverage data analytics – Integrating real‑time operational analytics can provide consumers and retailers with actionable insights, strengthening the firm’s value proposition.

- Enhance customer experience – Developing intuitive interfaces that reduce the learning curve for end‑users can differentiate Serve Robotics from competitors who focus solely on hardware.

These strategic moves align with broader market shifts toward “smart” consumer goods that blend physical and digital capabilities, a trend that has gained traction across retail, hospitality, and e‑commerce sectors.

Investment Takeaways

- Administrative Nature of Trades – The CFO’s sales are primarily tax‑related and do not indicate a strategic shift or impending decline in confidence.

- Volatility and Earnings Context – The negative earnings profile and steep share‑price decline warrant a cautious approach; any insider selling should be contextualized within the company’s financial health.

- Strategic Positioning – For long‑term holders, assessing the firm’s progress toward profitability and its capacity to innovate will be crucial. For prospective investors, the current price erosion may offer a discounted entry point, provided they are comfortable with the associated risk.

In sum, while Serve Robotics’ insider activity follows a routine pattern common to many consumer‑goods companies, the firm’s market‑price dynamics and financial performance underscore the importance of a nuanced, data‑driven approach to investment decision‑making.