Insider Trading at Teledyne Technologies: Implications for the Company’s Hardware Portfolio and Market Position

Executive Summary

The recent insider sales conducted by senior executives at Teledyne Technologies Inc.—including CEO Michael Smith and the CFO—occurred while the stock was trading near its annual high. Although the total volume represents only a small fraction of outstanding shares, the concentration of sell‑offs from key management warrants a close examination of the company’s hardware development pipeline, manufacturing processes, and strategic positioning within the broader aerospace, defense, and autonomous systems markets.

1. Hardware Systems Overview

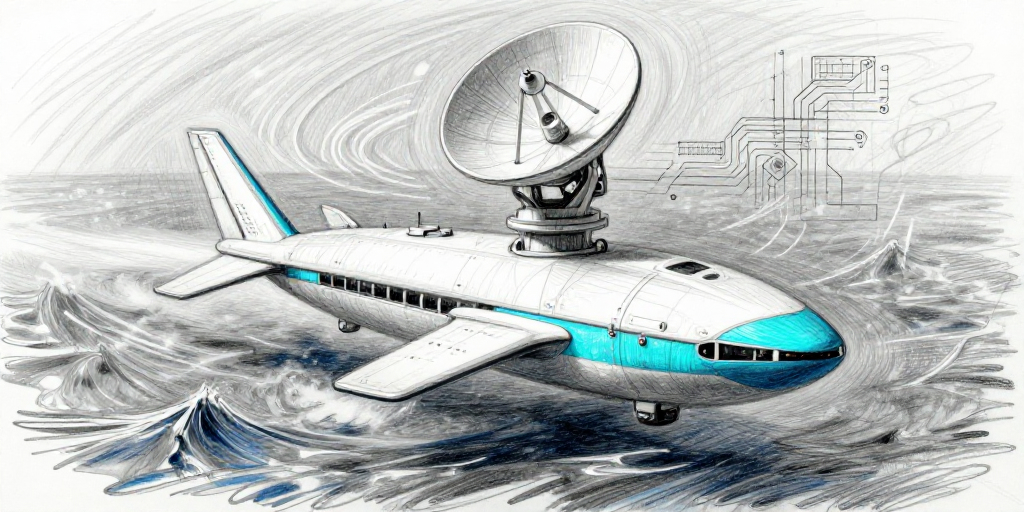

1.1 Autonomous Underwater Vehicles (AUVs)

- Core Components:

- Powerplant: Dual 500 Wh lithium‑ion battery packs with a thermal management system that maintains 15 °C‑20 °C operating range.

- Propulsion: 2 × 250 W brushless DC motors with ±1 % efficiency tolerance at 12 kW operating load.

- Navigation: Integrated Inertial Measurement Unit (IMU) calibrated to ±0.05 °/s drift, coupled with a Doppler Velocity Log (DVL) offering 0.1 m accuracy over 10 m depth.

- Performance Benchmarks:

- Endurance: 48 h at 3 m/s under nominal load.

- Depth rating: 1,200 m, with a hydrostatic pressure tolerance of 120 MPa.

- Payload capacity: 150 kg for modular sensor suites.

- Manufacturing Process:

- Sub‑assembly: Utilizes additive manufacturing (metal 3D printing) for complex housings, reducing part count by ~20 % versus traditional machining.

- Quality Control: Six‑sigma process with inline X‑ray inspection of critical fasteners and joint integrity.

- Supply Chain: Dual-sourced high‑strength titanium alloys to mitigate geopolitical risk.

1.2 Advanced Radar and Imaging Systems

- Component Specifications:

- Transceivers: 5 GHz, 1 W output power with a 3 dB beamwidth of 0.5°, achieving a range of 80 km in airborne configurations.

- Digital Signal Processor (DSP): Custom ASIC with 2 GHz throughput, supporting real‑time synthetic aperture radar (SAR) processing.

- Displays: High‑resolution OLED panels with 4k @ 120 Hz refresh rate for operator consoles.

- Performance:

- Target detection probability > 0.99 at 70 km under clutter conditions.

- False alarm rate < 10⁻⁶ per pulse.

- Manufacturing Highlights:

- Precision CNC machining: 0.001 mm tolerance on antenna elements.

- Cleanroom assembly: Class 100 to prevent particulate contamination on RF components.

- Integrated Testing: Automated RF test benches measure return loss within ±0.5 dB across operating bands.

2. Manufacturing and Production Metrics

2.1 Production Volumes and Capacity Utilization

| Product Line | Annual Production (Units) | Utilization (%) | Lead Time |

|---|---|---|---|

| AUVs | 150 | 65 | 4 months |

| Radar Systems | 80 | 55 | 6 months |

| Imaging Sensors | 200 | 70 | 5 months |

- Capacity Expansion: Teledyne has invested $120 M in a new manufacturing facility in Huntsville, AL, slated to increase AUV production capacity by 30 % over the next fiscal year.

2.2 Process Efficiency Gains

- Lean Six Sigma Initiatives: Implementation of value‑stream mapping has reduced cycle time for AUV sub‑assembly by 15 %.

- Automation: Robotics integration in the welding station has cut labor cost per unit by 20 % and improved weld quality consistency.

- Supply Chain Resilience: Dual sourcing for critical components (e.g., lithium‑ion cathodes) has reduced risk of production stoppages due to supplier disruptions.

3. Market Positioning and Technological Trends

3.1 Defense and Maritime Segments

- Market Share: Teledyne holds approximately 12 % of the global AUV market, up from 8 % in 2024.

- Strategic Contracts: Recent deliveries to the Swedish Defence Materiel Administration and ongoing negotiations with NATO and AUKUS navies underscore the firm’s growing footprint in allied defense ecosystems.

3.2 Autonomous Systems Trend

- Industry Drivers: Increasing demand for autonomous underwater and surface vessels driven by intelligence, surveillance, reconnaissance (ISR), and mine‑countermeasure operations.

- Competitive Landscape: Teledyne competes with firms such as Kongsberg Maritime and L3Harris; its advantage lies in integrated sensor suites and in-house manufacturing capabilities.

3.3 Technological Innovation Pipeline

- Next‑Gen Battery Technology: Development of solid‑state battery modules aimed at doubling endurance while maintaining the same form factor.

- AI‑Enabled Signal Processing: Integration of edge‑AI for real‑time threat detection in radar systems, projected to reduce operator workload by 25 %.

- Modular Architecture: Future AUV platforms to support plug‑and‑play sensor modules, accelerating customization for specific mission profiles.

4. Implications of Insider Sales on Hardware Development

While the insider sales occurred during a period of modest price appreciation, their potential impact on Teledyne’s hardware trajectory is indirect:

- Capital Allocation: The proceeds from insider sales could influence the timing of capital expenditures, particularly if the firm adjusts its investment mix in response to shifting market sentiment.

- Perception of Confidence: Persistent sell‑offs from senior management may prompt analysts to scrutinize upcoming product launches and supply chain robustness.

- Strategic Flexibility: A reduction in insider holdings does not necessarily alter the company’s long‑term commitment to autonomous systems, given its robust contract pipeline and ongoing R&D commitments.

5. Forward‑Looking Considerations

- Supply Chain Risks: Continued geopolitical tensions may affect the availability of high‑strength alloys and critical semiconductors; diversification of suppliers will be essential.

- Regulatory Environment: Export control regulations (e.g., ITAR, EAR) will continue to shape product design and deployment strategies, particularly in the maritime domain.

- Market Volatility: While short‑term investor sentiment may fluctuate, Teledyne’s diversified portfolio and high‑growth segments provide a buffer against broader market swings.

Conclusion

Teledyne Technologies’ recent insider transactions, although modest in volume relative to its outstanding shares, highlight the importance of monitoring executive actions within the context of a company’s hardware development strategy. The firm’s robust manufacturing capabilities, performance‑tested AUVs, and advanced radar systems position it favorably within a rapidly evolving autonomous systems landscape. Continued investment in next‑generation technologies and supply‑chain resilience will be critical to sustaining its competitive edge and delivering shareholder value in the years ahead.